Child Investment Plans in India: Explore Post Office Schemes, FDs, SIP and More

Ever wondered how to make sure your little one has a happy and financially secure future? It’s not just about saving money; it’s about making a foundation for both short and long-term money goals. It’s all about mutual funds, stock trading investments, saving schemes, and special child investment plans in India.

While choosing the best saving scheme in India, striking a balance between growth and stability ensures a solid base. In this pursuit, we bring you a guide that goes beyond just saving – a simple approach to choosing the best child investment plans in India.

We have shared the latest and best saving schemes in India for children, offered by the post office and banks, to help you choose the best investment for your new baby.

Let us start!

Investment Plan for Child Future – Why Do You Need One?

We all dream big for our little ones, right?

But let’s face it: with the skyrocketing costs of education, healthcare, and the glam lifestyle they might want, planning is the superhero cape we need.

So, what’s the game plan?

Child investment plans – the path to stress-free parenthood!

These saving plans aren’t just about saving money; they’re your secret weapon to fund your mini-me’s dreams, whether it’s jet-setting for education or throwing the grandest wedding in town.

By choosing the best investment plan for child’s future, you can benefit from stress-free parenthood and also gain some tax advantages.

There are various types. You can choose the best investment plan for child’s future, taking into account your income stream, your risk-taking capability, and expected returns.

Remember, the best investment plan for a child starts with early investing – the earlier you start, the more you can save for your child’s future.

Best Saving Scheme in India: Exploring the 8 Post Office Schemes for Children

We Indians often look at Government schemes as the best investment for kids.

People consider these investment schemes to be the best child plans for education and marriage.

Here are some post office schemes for children with the best investment plans for your child’s future in India,

Explore these child investment plans, such as PPF, KVP, NSC, and more, within these post office schemes for children to find the ideal fit for your child.

1. Public Provident Fund (PPF)

PPF is one of the best saving plans for children in India, backed by the government. It offers a high interest rate of 7.1% per annum, along with tax benefits.

Opening a 15-year Public Provident Fund (PPF) account is a great move for securing your child’s future – the best among the child investment plans in India.

Now, why might parents want to consider this as the best child plan for education and marriage for their kids?

- Premium Payment Frequencies: Minimum of ₹500 to a maximum of ₹1,50,000 per annum.

- Investment Options: Make deposits lump-sum or in instalments.

- Unique Plan Benefits: Tax benefits under Section 80C, guaranteed returns, and tax-free interest.

Imagine starting with just INR 500 – a small beginning that won’t affect your pocket.

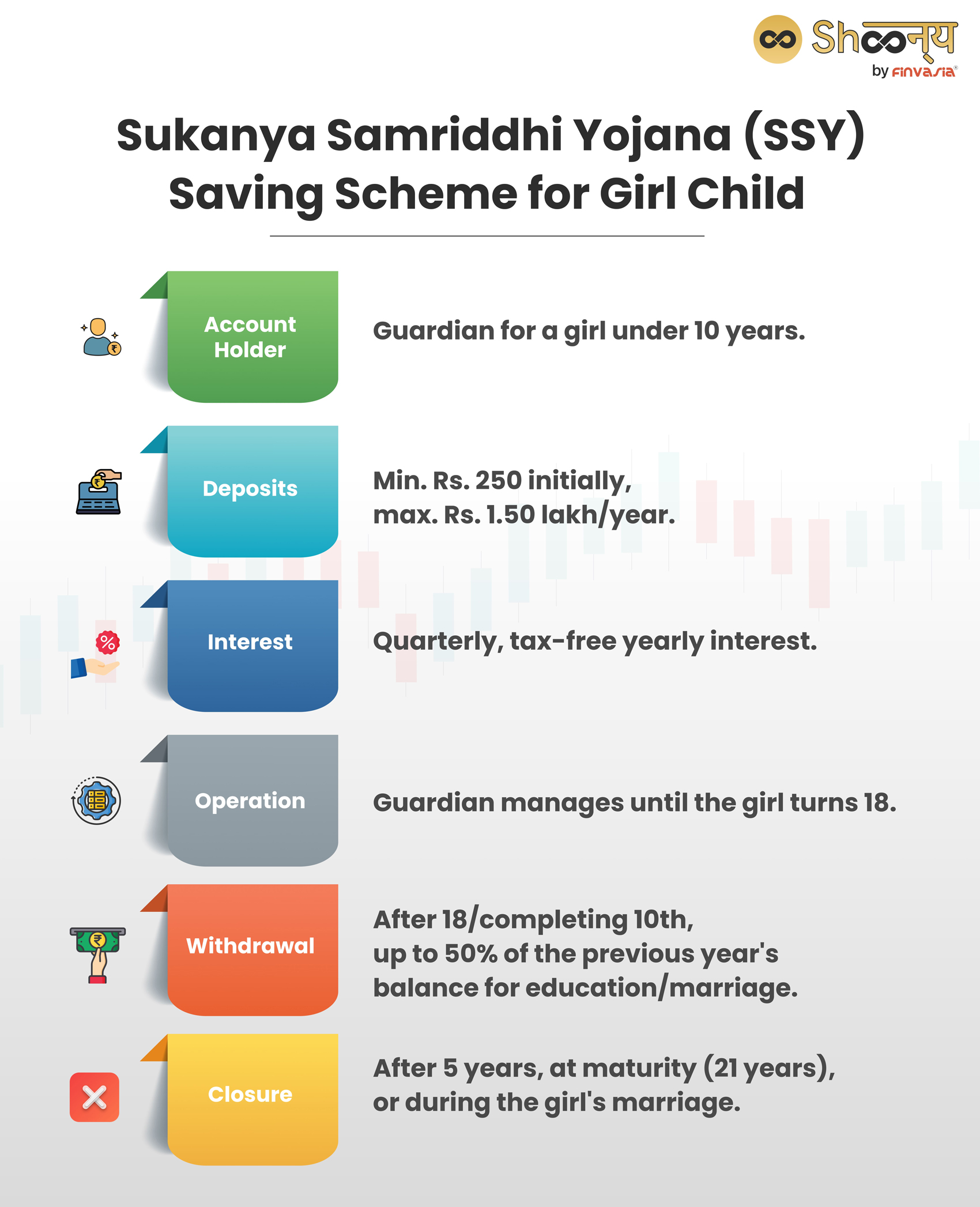

2. Sukanya Samriddhi Yojana (SSY)- Saving Scheme for Girl Child

Do you have a daughter or a niece who is below 10 years old?

Do you want to secure her future and help her achieve her dreams?

How about another best investment plan for a child’s future?

SSY is a Saving Scheme for Girl Child, launched by the Government of India in 2015 as part of the Beti Bachao Beti Padhao campaign.

SSY is one of the best saving schemes for girl child, as it offers a high return, low risk, and tax benefits.

Also Read- 6 Essential Investment Options Every Woman Should Explore

Key Points of the Saving Scheme for Girl Child

So, why should moms and dads think about choosing Sukanya Samriddhi Yojana for their little girls?

- Premium Payment Frequencies: Minimum of ₹250 to a maximum of ₹1,50,000 per annum.

- Investment Options: Make deposits in lump-sum with no limit on the number of deposits in a month or year.

- Unique Plan Benefits: Tax benefits under Section 80C, competitive interest rates, tax-free interest. Waiver of premiums available upon account revival after default.

Well, it comes with an 8.2% interest rate every year, something that makes parents really happy.

Key Points of the Saving Scheme for Girl Child

3. Post Office Savings Account

Do you want to save money for your child’s future goals and also earn a decent interest rate on your savings without paying any tax?

If yes, then you should consider opening a Post Office Savings Account.:

- Premium Payment Frequencies: No specific premium payment frequency; make deposits anytime.

- Investment Options: Minimum opening amount of ₹500.No, maximum limit on deposits.

- Unique Plan Benefits: Offers a competitive interest rate of 4.0% per annum. Nomination is mandatory. Interest credited annually, with interest up to ₹10,000 exempted from taxable income under Section 80TTA of the Income Tax Act. Waiver of account closure fees if the balance is maintained above ₹500.

Who Can Open Post Office Savings Account

Single adults, two adults jointly, guardians for minors or persons of unsound mind, and minors above 10 years old can open an account.

4. Post Office Monthly Income Scheme

The Post Office Monthly Income Scheme (POMIS) is an investment scheme introduced in 1987 and recognised by the Ministry of Finance.

Offering a fixed monthly income for 5 years, this is one of the best savings schemes in India.

It’s not just any child investment plan, but one of the best investments for kids!

And here’s the smart move – parents can tap into the maturity amount to handle their kiddos’ monthly expenses.

- Premium Payment Frequencies: Lump sum investment with a maximum limit of ₹4.5 lakh for a single account and ₹9 lakh for a joint account.

- Investment Options: Provides a fixed monthly income for 5 years at a competitive interest rate (7.4% as of September 30, 2023).

- Unique Child Investment Plan Benefits: Guaranteed monthly income for a specified period. Income is not subject to TDS (Tax Deducted at Source), and this saving scheme for child education and marriage allows for account transfer between post offices.

However, it does not provide tax benefits under income tax regulations.

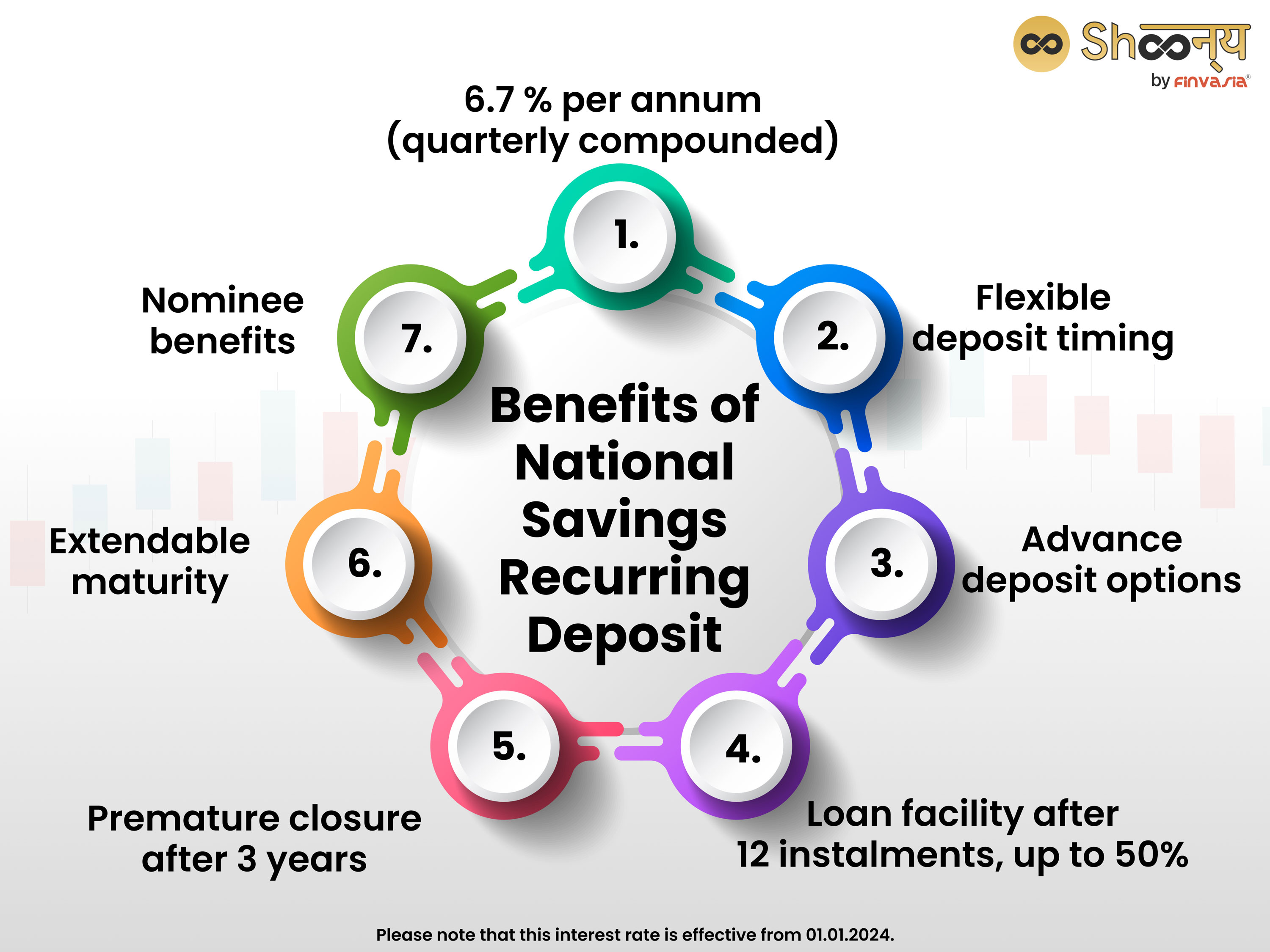

5. National Savings Recurring Deposit Account

The National Savings Recurring Deposit Account, also known as the 5-Year Post Office Recurring Deposit Account (RD), is a go-to choice among post office schemes for children.

- Premium Payment Frequencies: Minimum deposit of ₹100 per month or any amount in multiples of ₹10, with no maximum limit.

- Investment Options: Allows opening by a single adult, joint account (up to 3 adults), or a guardian on behalf of a minor or person of unsound mind.

- Unique Plan Benefits:

- Offers a fixed interest rate of 6.7% per annum (quarterly compounded).

- Flexibility in deposit timing based on account opening date.

- Advance deposit options are available with rebates.

- Loan facility after 12 instalments, up to 50% of the account balance.

- Premature closure permitted after 3 years, subject to applicable interest rates.

- The maturity period of 5 years, extendable for another 5 years.

- Nominee can claim the account balance in case of the account holder’s demise, with the option for nominees/legal heirs to continue the account till maturity.

So, why might parents want to consider this child investment plan account for their kids?

Imagine having a reliable way to save and grow money, with the flexibility to contribute as much as you can each month.

6. National Savings Certificate (NSC)

The National Savings Certificate (NSC) is a government-backed plan and is one of the other options among the best investments for kids in India.

For the National Savings Certificates (NSC):

- Premium Payment Frequencies: Minimum of ₹1,000 and in multiples of ₹100, with no maximum limit.

- Investment Options: A single adult, joint account (up to 3 adults), or a guardian on behalf of a minor or person of unsound mind.

- Unique Plan Benefits:

- Offers a fixed interest rate of 7.7% per annum compounded annually but payable at maturity.

- Deposits qualify for deduction under Section 80C of the Income Tax Act.

- The maturity period is five years from the date of deposit.

- Allows the transfer of the account under certain circumstances like the death of the account holder to nominees/legal heirs, joint holders, or by court order.

So, why should parents think about this?

It’s like a smart and secure investment plan for child’s future and their big moments.

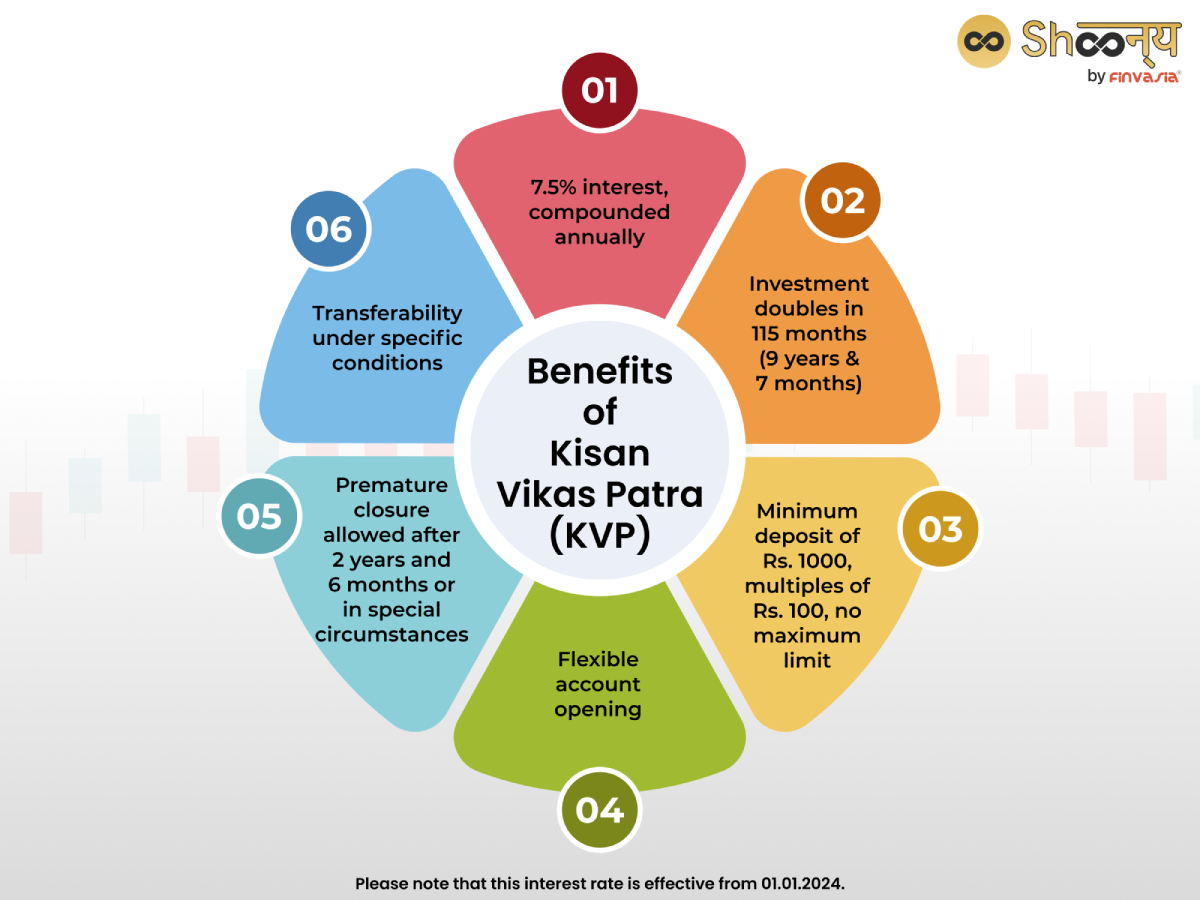

7. Kisan Vikas Patra (KVP)

Here is another post office scheme for children- Kisan Vikas Patra (KVP).

It is a government-backed plan that works like a magic doubler for your money in just (9 years & 7 months)

Many middle-class families see it as the top pick when it comes to choosing the best investment for new baby among middle-class families.

Kisan Vikas Patra (KVP)

- Premium Payment Frequencies: Minimum of ₹1,000 and in multiples of ₹100, with no maximum limit.

- Investment Options: Can be opened by a single adult, joint account (up to 3 adults), or a guardian on behalf of a minor or person of unsound mind. Multiple accounts can be opened.

- Unique Plan Benefits:

- Offers a fixed interest rate of 7.5% per annum compounded annually.

- The amount invested doubles in 115 months (9 years and 7 months).

- It permits premature closure after 2 years and 6 months from the date of deposit. However, it is subject to specific conditions such as the death of the account holder, court order, or forfeiture by a pledgee.

8. Balika Samridhi Yojana

This is one of the best investments for kids.

It is a government-sponsored scheme that provides financial assistance to the girl’s child and her family.

The Balika Samriddhi Yojana, started on October 2, 1997, aims to improve the status of girl children and foster positive changes in family and community perspectives.

This program includes support for up to two girls born after August 15, 1997, in families identified as living below the poverty line by the Government of India.

So, why is this saving scheme for girl child significant?

It’s like a caring initiative that supports families in need and ensures that girls have the secure future that they deserve.

Benefits of Post Office Schemes for Children

Post office schemes are popular choices for saving and investing for children in India, offering several advantages:

- The government backs the Post office schemes. These offer guaranteed returns and protection.

- Post office schemes for children don’t just play it safe; they play it smart with attractive interest rates

- It’s not just about saving; it’s about saving smartly. Schemes like PPF, NSC, and SSY come with tax exemptions on the money you put in, the interest it earns, and even the total amount at maturity.

- With minimal deposit requirements ranging from Rs. 100 to Rs. 1000, post office schemes are affordable and accessible to everyone.

Choose the Best Investment for the New Baby

Investing in your baby’s future is a thoughtful way to secure their financial well-being.

Here are some simple and effective options you can consider:

1. Fixed Deposits (FD)

These are bank deposits that offer a fixed rate of interest for a specified period of time. They are safe and stable but may not offer high returns compared to other investments. You can open an FD in your child’s name or as a joint account with you as the guardian.

Why?

It’s safe, but the extra money you get may not be a lot.

2. Recurring Deposits (RD)

These are similar to FDs, but you deposit a fixed amount every month for a certain duration. They also offer a fixed rate of interest but may be lower than FDs. They are suitable for saving small amounts regularly.

Why?

Good for saving small amounts regularly, and it’s safe.

3. Systematic Investment Plan (SIP)

This is a way of investing in mutual funds where you invest a fixed amount every month in a chosen fund.

The fund invests in various securities such as stocks, bonds, etc.

- Investing in equity mutual funds through a Systematic Investment Plan (SIP) is a powerful way to secure a child’s financial future.

- SIPs offer the flexibility of investing small amounts regularly, making it accessible for parents to build wealth over time.

- Equity mutual funds offer a potent avenue for securing a child’s financial future.

With the option of Systematic Investment Plans (SIPs) or lump sum investments, parents can choose their contributions to align with their financial capacity and goals.

Why?

It can give you more money over time, but there’s a bit more risk.

4. Gold

This is a traditional and popular investment option for Indians.

You can buy gold in physical form, such as jewellery, coins, bars, etc., or in digital form, such as gold ETFs, gold mutual funds, gold bonds, etc.

Choosing gold as an investment plan for child’s future can be a stable choice, as gold often maintains its value over time.

You can easily pass down Physical gold, like jewellery or coins.

However, it requires secure storage and can have higher transaction costs.

Digital gold allows for easier trading and tracking of current values, and it doesn’t need physical storage.

However, it lacks the tangible aspect of physical gold and may be subject to digital risks like hacking.

Why?

It is believed to be the best investment for kids in India, but you need to double-check and buy the physical gold only from reputed jewellers.

5. Insurance

For a child, the purpose of an insurance policy is to provide financial protection and support for their well-being and future.

The best way to do this is to buy a life insurance plan for your kid.

Choose among the top Insurance companies in India!

Investment Strategy for Child Investment Plans

Here are a few strategies you could adopt before choosing the best investment for kids:

- Define Clear Goals: Set specific goals. For example, make your child’s education a priority. Once you have done this, you can easily figure out the amount you can invest in your child’s future, such as retirement or healthcare.

- Assess Affordability: Evaluate how much you can save after covering essential expenses like education and healthcare.

- Consider Loan Options: Recognize that education can be partially funded through loans. With that, you can ease the burden of saving.

- Adjusting Equity Exposure: You must keep a check on equity exposure to protect against market downturns.

- Choosing Between Debt and Equity Funds: Determine your risk tolerance and investment horizon when selecting between stable debt funds and growth-oriented equity funds.

Systematic Investment Plans (SIPs): Understand the benefits of SIPs. They offer flexibility and can align with long-term financial goals.

Things to Keep in Mind While Choosing the Best Investment for Kids

When investing in your child’s future, consider these key factors:

- Your investment goal influences the type of saving schemes you need.

- Choose an investment plan for your kid that suits your budget, offers tax benefits, and be mindful of associated charges.

- Spread your investments across different plans and sectors to balance risk and return. You could use a mixed investment strategy.

Documentation Required for Purchasing Child Savings Plans

- An application form

- KYC documents of the parent/legal guardian (e.g., Aadhaar card, PAN card, passport) to verify identity and address.

- Passport-sized photographs of the child and parent/legal guardian.

- Include a proof-of-age document for the child.

Eligibility Criteria for Purchasing Child Investment Plans

For Plans with Child as Insured Person:

- The child must be an Indian citizen.

- Entry age ranges vary depending on the plan (e.g., from 0 years to a maximum of 60 years)

- The parent/legal guardian must be an Indian citizen.

These requirements and criteria ensure that the child’s savings and investment plans are accessible and appropriate.

Conclusion

From government schemes to investing in mutual funds and FDs in bank options, we’ve simplified the choices.

The future awaits, and with the best child investments in place, you’re not just securing financial stability; you’re building a bridge to your child’s dreams.

Remember, the key lies in comparison – weighing the pros and cons, understanding the purpose, and then choosing the best investment for kids that aligns best with your child’s aspirations.

Happy planning!

FAQs

You can plan savings for your child by choosing a suitable investment option that matches your income stream and the return that you are expecting. Best investments for kids include savings bank accounts, insurance policies, gold, post office savings schemes, PPF accounts, KVP, etc.

You can save money for your children’s future by setting a budget, tracking your expenses, and investing in child investment plans such as PPFs, FDs, Kisan Vikas Patras, NSCs, etc.

One of the best saving plans for the child is the Public Provident Fund (PPF), which is a government-backed scheme that offers a high interest rate of 7.1% per annum, tax benefits, and a long maturity period of 15 years. PPF is a safe and secure way to build a corpus for the child’s future education, health, and marriage.

Sukanya Samriddhi Yojana (SSY) is a special savings scheme for the girl child. SSY offers a high-interest rate of 8.2% per annum, tax benefits, and a flexible deposit option.

Source- india.gov.in, indiapost.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.