Mahila Samman Savings Certificate Scheme| Features, Eligibility, and Benefits

Are you a daughter, mother or a single independent lady who is often overwhelmed by the mere idea of securing your financial future? What if we told you that the Ministry of Finance offers an incredible savings scheme for women? Have you heard about the Mahila Samman Savings Certificate scheme?

It is a women’s savings scheme that is available for subscription in the post offices and eligible scheduled banks.

What exactly is the Mahila Samman Savings Certificate scheme, and how can it benefit you?

Let us take a look!

Key Highlights | Mahila Samman Savings Scheme

1. Accessible through Public and Private Sector Banks and Post Offices.

2. Aimed at financial empowerment of girls and women.

3. Open for subscription until March 31, 2025, with a 2-year tenure.

4. Attractive interest rate of 7.5% per annum, compounded quarterly.

5. Investment range: Minimum of ₹1000 up to a maximum of ₹200,000.

6. The maturity period is two years from the account opening date.

7. Partial withdrawal allowed, up to 40% of the balance during the tenure.

Mahila Samman Savings Certificate Scheme Details

The Department of Economic Affairs, Ministry of Finance, launched the Mahila Samman Savings Certificate scheme to provide financial security to every girl and woman in India.

Here is everything about the Mahila Savings Scheme:

What is the Mahila Samman Savings Certificate?

The Mahila Samman Savings Certificate is a one-time women’s savings scheme announced by the government in the Budget 2023.

Its purpose is to empower women by encouraging their participation in investments. This scheme is government-guaranteed, which means it provides a secure investment option for women.

It has been running since April 1, 2023, and is valid until March 31, 2025.

Public Banks and eligible Private Sector Banks are permitted to implement the scheme.

Who Can Benefit from This Scheme?

- Any girl or woman in India can benefit from the Mahila Samman Savings Certificate.

- There is no upper age limit, so women of all ages can participate.

- Even minor girls can open an account under this scheme with the help of a guardian.

What are the Features of the Mahila Samman Savings Scheme

The popular Mahila Samman Savings Certificate scheme has some unique aspects:

- Attractive Investment Options

This women’s saving scheme provides appealing and secure investment opportunities for all girls and women.

- Account Opening

You can open an account under this women’s savings scheme on or before March 31, 2025, for a tenure of two years.

- Mahila Samman Savings Scheme Interest rate

The deposit made under MSSC will let you earn an interest rate of 7.5% per annum, compounded quarterly.

- Deposit Limits

This women’s saving scheme allows you a minimum deposit of ₹1,000/-, with any sum in multiples of 100. However, you can do this within the maximum limit of ₹2,00,000/-.

- Maturity Period

The investment under the Mahila Samman Savings Certificate scheme matures after two years from the date of opening the account.

- Flexibility

It also offers flexibility in investment and partial withdrawal during the scheme tenure.

If needed, you can withdraw a maximum of up to 40% of the eligible balance in the mahila savings scheme account.

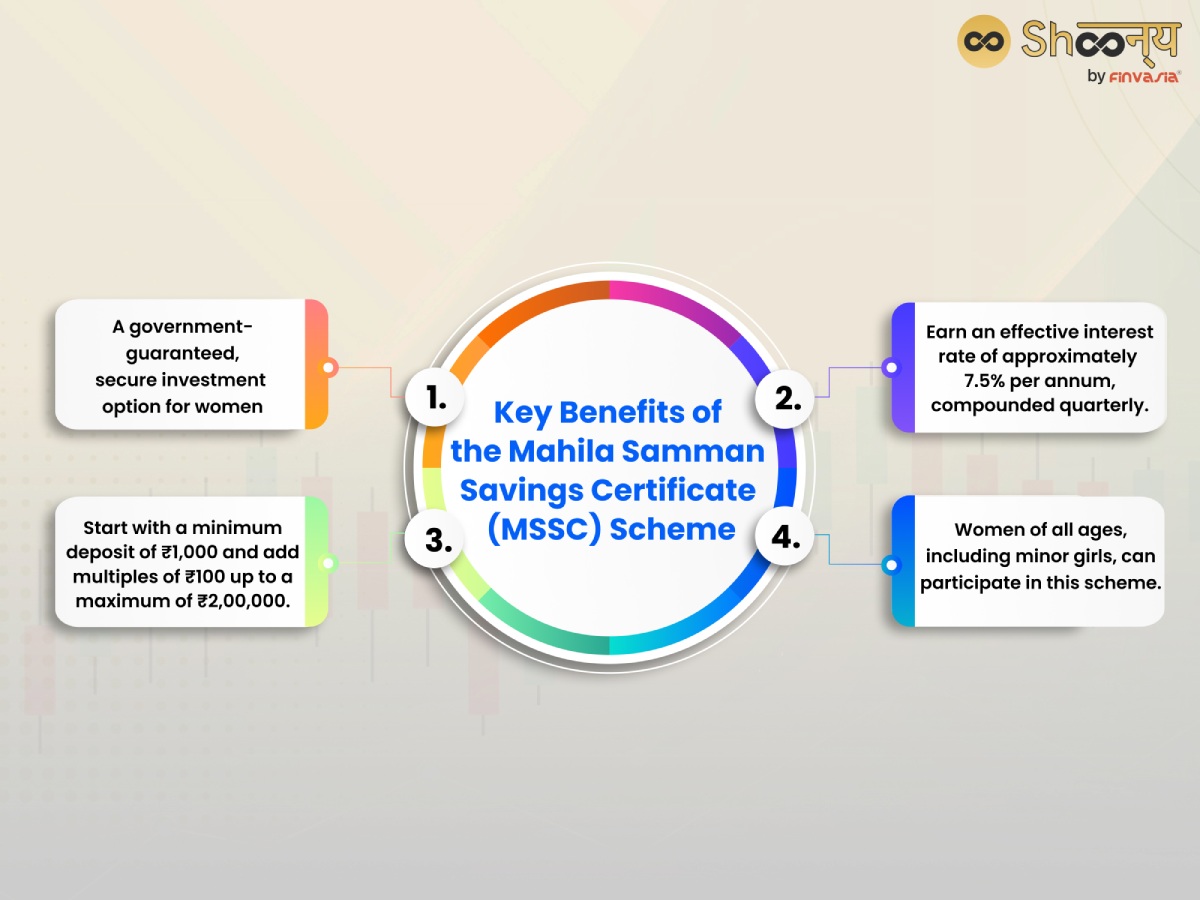

Mahila Samman Savings Certificate (MSSC) Benefits

A government-guaranteed, secure investment option for women.

Earn an effective interest rate of approximately 7.5% per annum, compounded quarterly.

Start with a minimum deposit of ₹1,000 and add multiples of ₹100 up to a maximum of ₹2,00,000.

Women of all ages, including minor girls, can participate in this scheme.

Still thinking about the suitability of this woman’s saving scheme for yourself?

Have a look at the benefits of the Mahila Samman Savings Certificate Scheme:

- Attractive and Secure Investment Options:

- Provides appealing and secure investment options to all girls and women.

- Fixed Interest Rate:

- Offers an attractive fixed interest of 7.5% compounded quarterly.

- Flexible Investment and Partial Withdrawal:

- Allows flexible investment and partial withdrawal options.

- Maximum ceiling of ₹2,00,000/-.

- Quarterly Interest Compounding:

- Interest is compounded quarterly and credited to the account.

Eligibility Criteria For Mahila Samman Savings Scheme

Here are certain con editions that you must fulfil in order to benefit from this government scheme:

- Indian Citizenship:

- You must hold Indian citizenship.

- Women and Girl Children:

- This scheme is exclusively for women and girl children.

- Individual Woman Applicants:

- Any individual woman can apply under the scheme.

- Minor Accounts:

- Even guardians can open minor accounts.

- No Upper Age Limit:

- Women of all ages can benefit from this scheme.

Mahila Samman Savings Scheme| Additional Requirements

The women’s saving scheme has some additional guidelines related to the application, deposits, withdrawals and more!

Deposit Guidelines for Your Account

- Number of Accounts:

- Individuals can open any number of accounts, with a three-month gap between each account.

- Minimum Deposit:

- You can make a minimum deposit of ₹1000/— with subsequent deposits in multiples of one hundred rupees.

- Maximum Deposit:

- The maximum limit for deposit is ₹2,00,000/- per account holder.

Maturity Payment Process

- Maturity Period:

- Deposits mature after two years from the deposit date.

- Maturity Value Calculation:

- Under this mahila saving scheme, any fraction of a rupee is rounded off to the nearest rupee.

- Consider fifty paisa or more as one rupee, while anything less than fifty paisa gets ignored.

Withdrawal Procedure

- Maximum Withdrawal

- Account holders can withdraw up to 40% of the Eligible Balance after one year from the account opening but before maturity.

- Withdrawal for Minor Accounts

- Guardians can apply for withdrawal on behalf of minor girls by submitting specified certificates to the accounts office.

- Withdrawal Calculation

- Similar to maturity value calculation, fractions of a rupee are rounded off.

- Fifty paisa or more is considered as one rupee, while less than fifty paisa is ignored.

Can the Mahila Samman Savings Certificate be closed before its term?

Yes, investors can close the account early under specific circumstances. They can do so six months after opening without needing a reason.

In this case, the interest rate will be two percent lower.

Other situations for early closure include the death of the account holder or extreme compassionate reasons.

How Can You Apply for the Mahila Samman Savings Certificate Scheme

Here is the step-by-step application process for the Mahila Savings scheme:

- You must visit your closest Post Office Branch or a designated bank to take the Mahila Samaan saving certificate scheme form.

- You can directly download it from the official website.

- Next, you must fill in the application form and attach all the necessary documents.

- Declare and Nominate:

Fill in the declaration and nomination details as required. - Once done, you need to submit the filled-out application form along with the initial investment/deposit amount.

- You’ll receive a certificate as proof of your investment in the MSSC Mahila Samman Savings Certificate scheme.

Remember:

In order to benefit from this scheme, women can apply for themselves. For the minors, their guardians can apply on behalf of minor girls before March 31, 2025.

Premature Closure

If you need to close your account early:

- You cannot normally close your account before it matures, except:

- If the account holder passes away.

- In cases of severe situations like life-threatening illness or the guardian’s death causing undue hardship, the post office or bank may allow early closure after proper documentation.

- If you close your account early, you will get the Mahila Samaan savings scheme interest rate on the principal amount according to the scheme’s rate.

- If you close the account after six months from opening for reasons other than those mentioned, the balance will earn interest at a rate 2% lower than the scheme’s rate.

When calculating the final value by rounding off any fraction of a rupee, consider fifty paise or more as one rupee and ignore anything less than fifty paise.

You may also want to know the Pradhan Mantri Mudra Yojana

What are the Documents Needed for the Mahila Samman Savings Scheme

| Documents Required |

| 1. Passport size photograph |

| 2. Proof of age, i.e. Birth Certificate |

| 3. Aadhaar Card |

| 4. PAN Card |

| 5. Pay-in-Slip along with deposit amount or cheque |

| 6. Valid documents for identification and address proof: |

| – Passport |

| – Driving license |

| – Voter’s ID card |

| – Job card issued by NREGA signed by the State Government officer |

| – Letter issued by the National Population Register including details of name and address |

Conclusion

The Mahila Samman Savings Certificate Scheme (MSSC) is a government-guaranteed opportunity aimed at empowering women financially. With an attractive interest rate of 7.5% per annum compounded quarterly, it offers a secure investment option for women of all ages, including minor girls. If you are looking to secure your financial future, the Mahila Samman Savings Scheme is indeed a great option.

FAQs| Mahila Samman Savings Certificate Scheme

Women who invest in this scheme will earn a 7.5% interest every year on their one-time deposit. The scheme is valid for 2 years.

Your account matures after two years from the opening date. At that time, you’ll receive the money you’ve saved up.

Yes, a Mahila Samman savings account can be opened online using the official portal or through authorised banks offering this service.

The choice between Sukanya Samriddhi Yojana (SSY) and Mahila Samman Saving Certificate (MSSC) depends on individual financial goals; SSY is ideal for long-term savings for a girl child’s education and marriage, while MSSC offers a fixed return with a shorter maturity period.

Source- myscheme.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.