It is often said that mutual fund investments can help you achieve your financial goals effectively. Mutual funds have gained immense popularity as a preferred investment choice for numerous investors owing to the multiple benefits of mutual funds.

While the benefits of mutual funds investments are multiple, it is crucial to know what mutual funds are, the various types of mutual funds in India, and how mutual funds actually work. Are they good investment options in India?

Let us explore.

- What are Mutual Funds?

- Benefits of Investing in Mutual Funds

- Professional Management: Unleash the Power of Expertise

- Diversification: Embrace Steady Growth through Variety

- Accessibility: Your Gateway to Financial Markets

- Liquidity: Quick and Convenient Access to Your Funds

- Affordability: Grow Your Wealth without Breaking the Bank

- Tax Benefits: Save More as You Invest

- Transparency: Know What You’re Investing In

- Rupee Cost Averaging: Tame the Market Volatility

- Flexibility: Tailor Your Investment Journey

- Wealth Creation: Let Your Money Grow with Time

- How do Mutual Funds Work?

- Types of Mutual Funds: Ways to Investing in India

- How to Start Investing in Mutual Funds?

- Key Takeaways

- FAQ

What are Mutual Funds?

Mutual funds are like financial clubs where many people pool their money together to invest in different types of assets, like stocks, REITs, commodities, cash equivalents and bonds. A professional manager handles these investments on behalf of all members, making it an easy and diversified way for beginners to invest in the stock market through mutual funds.

Mutual funds are like a team effort in the stock market. It’s like a group of friends pooling their money together to buy various items they like. A professional manager leads the team and invests the money in different things, like company shares, bonds, and government securities. When these investments make a profit, everyone in the team gets a share based on how much they contributed.

Mutual Fund investments are an easy and smart way to invest in the Indian stock market. So, if you want to enjoy the benefits of mutual funds, go ahead and get started today!

Benefits of Investing in Mutual Funds

The most important reason for the popularity of mutual funds in India is that Investing in mutual funds brings numerous benefits, making it an attractive choice for investors.

Mutual fund benefits include diversification across various securities like stocks, equities, and bonds, expert money management by professionals, cost advantages due to pooling resources, clear transparency in operations, and much more.

Professional Management: Unleash the Power of Expertise

When you invest in mutual funds, you get access to experienced fund managers who act like skilled captains guiding your mutual fund investment journey. These experts closely analyse market trends, handpick the best-performing stocks and bonds, and adjust your portfolio to ensure maximum returns and experience the benefits of mutual funds in the best way possible. It’s like having a captain steering your ship, helping you work on your chosen best mutual funds. Professional management is the most important benefit of mutual funds in India.

Diversification: Embrace Steady Growth through Variety

Imagine you have a basket of fruits, each with its unique flavour and taste. In mutual funds, your money is spread across various assets like stocks, gold, cash equivalents, bonds, and other money market instruments. If one investment underperforms, others can balance it out, reducing the overall risk. This is another important benefit of mutual funds, as diversification ensures that all your investments are not in one basket, safeguarding you from sudden market swings.

Check out the best mutual funds to invest in India!

Accessibility: Your Gateway to Financial Markets

Entering the stock market solo might seem overwhelming, but mutual funds in India offer an accessible gateway. With a small investment, you become part of a diversified portfolio managed by mutual fund experts. It’s like having a key to the financial market without needing to be a trading expert for investing in mutual funds.

To experience the benefits of mutual funds, your mutual fund investment journey should flow smoothly, with professionals handling the complexities for you.

Liquidity: Quick and Convenient Access to Your Funds

Unlike investing in real estate or other traditional avenues, mutual funds investment provides quick and convenient access to your money. One of the key benefits of mutual funds is the fact that whether you need funds for an emergency or a great opportunity, you can easily redeem your mutual fund units and receive your money promptly.

Note- Mutual funds investment provides quick and convenient access to your money, but the liquidity of mutual funds may vary depending on the type of fund and the market conditions. Withdrawing the funds for liquidity may also be subject to exit load fees.

Check out Security +Growth=Pure term Plans+MF Combo.

Affordability: Grow Your Wealth without Breaking the Bank

Do you think building wealth demands massive amounts of money? Not with mutual funds! You can start investing with even a small amount. This is another attractive benefit of mutual funds investment.

Through systematic investment plans (SIPs), you invest a little regularly, and over time, you watch your fund grow steadily.

It’s an affordable way to participate in the financial market’s growth.

Tax Benefits: Save More as You Invest

Mutual funds in India often offer tax benefits that help you save money while your investments grow.

According to the Union Budget 2023, there has been a significant change in the taxation rules for debt funds effective from April 1, 2023.

• Only ELSS mutual funds offer tax benefits under Section 80C of the Income Tax Act, 1961. Other mutual funds are taxed as capital gains.

• Specified mutual funds, which invest less than 35% in equity, will lose the indexation benefit for gains from April 1, 2023. Other debt funds will still have the indexation benefit for LTCG if held for more than 36 months.

• ELSS mutual funds have a lock-in period of three years and are subject to LTCG tax at 10% if the gains exceed Rs 1 lakh in a financial year.

• Dividend income from mutual funds is taxable to investors at their applicable slab rates. There is no DDT on mutual funds.

Transparency: Know What You’re Investing In

With mutual funds, transparency is a guiding principle. Fund houses provide detailed information about their investment strategies, portfolio holdings, and past performance.

It’s like having a clear window into your mutual fund investments, empowering you to make well-thought-of decisions as when you trade in mutual funds in India.

Rupee Cost Averaging: Tame the Market Volatility

Market ups and downs can be nerve-wracking for beginners. This serves as a crucial benefit of investing in mutual funds. With systematic investment plans (SIPs), you benefit from rupee cost averaging.

When the markets are down, your SIP buys more units at lower prices, and when they rise, you buy fewer units at higher prices. Over time, this balances the impact of market fluctuations, helping you achieve a favourable average purchase price.

Flexibility: Tailor Your Investment Journey

Mutual funds cater to various investment goals. Whether you’re aiming for short-term gains, long-term growth, or specific financial objectives like retirement or education, there’s a mutual fund in India suited to your needs. Choose funds after analysing each category and analysing the benefits of mutual funds aligned with your risk tolerance and objectives, giving you a personalised investment journey.

Wealth Creation: Let Your Money Grow with Time

With mutual funds investment, the power of compounding works its magic. As your investments generate returns, these gains are reinvested. One of the interesting benefits of mutual funds is that they allow your money to grow exponentially over time.

It’s like planting a tree and watching it grow into a magnificent forest. The earlier you start investing, the longer your money has to grow, creating wealth for your future.

In essence, the benefits of mutual funds in India are multi-faced. They offer a straightforward way to invest in a mix of assets and enjoy the advantages they bring to your overall financial experience in the stock market.

How do Mutual Funds Work?

Mutual funds, a popular investment vehicle in India, bring many investors together to create a diversified portfolio of stocks, commodities, bonds, and other securities. Here’s how it works:

- Investors purchase shares in a mutual fund, representing a portion of the fund’s holdings.

- Professional money managers handle the fund, making investment decisions on behalf of shareholders.

- The fund’s assets are invested in a diverse range of securities, aligning with its objective and strategy.

- The fund’s value is determined by the net asset value (NAV) calculated from its total assets divided by the shares outstanding.

- Investing in mutual funds can be open-ended or closed-ended, offering flexibility for buying and selling shares.

- Fees like management fees and expense ratios may apply, impacting overall returns.

Beginners can enjoy the benefits of mutual funds, like diversification, professional management, and liquidity, as they take steps toward financial growth via mutual funds investment in India. However, research is a must task that you need to perform at every point.

Types of Mutual Funds: Ways to Investing in India

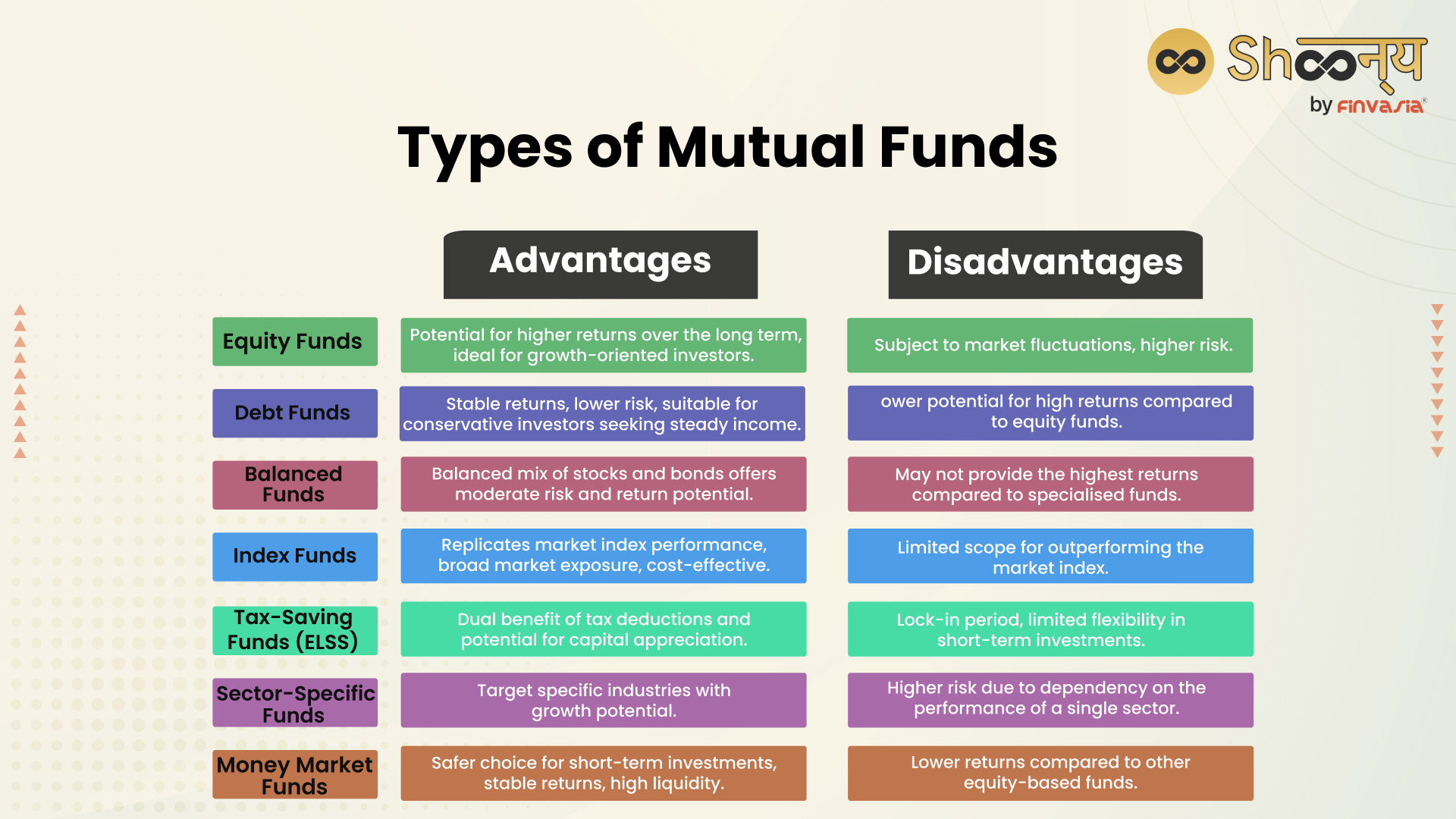

Mutual funds in India come in various types, catering to different investment goals and risk appetites, with each offering unique benefits of mutual funds, allowing investors to capitalise on the advantages they provide. Let’s explore them:

Equity Funds

These funds invest primarily in Indian company stocks. They offer the potential for higher returns over the long term but may be subject to market fluctuations. Mutual fund investment made in these is perfect for growth-oriented investors seeking to ride the stock market’s ups and downs.

Debt Funds

Ideal for conservative investors, debt funds invest in fixed-income securities like government and corporate bonds. They provide stable returns and lower risk compared to equity funds, making them suitable mutual fund investment choices for steady income seekers.

Balanced Funds

As the name suggests, these funds strike a balance by investing in both stocks and bonds. These mutual funds in India offer moderate risk and return potential, making them a balanced choice for investors seeking a mix of growth and stability.

Index Funds

These types of mutual funds in India replicate the performance of a specific stock market index, like NIFTY 50 or SENSEX. They offer broad market exposure and generally have lower expense ratios, making them cost-effective choices for mutual fund investment in India.

Tax-Saving Funds (ELSS)

Equity Linked Savings Schemes (ELSS) come with a dual benefit. They offer tax deductions under Section 80C of the Income Tax Act and the potential for capital appreciation. Ideal for investors looking to save on taxes while aiming for long-term growth.

Sector-Specific Funds

These mutual funds in India focus on specific industries or sectors, like technology or healthcare. They offer opportunities to invest in sectors with potential for growth.

However, sector-specific mutual funds also carry higher risk as they are dependent on the performance of a single sector, which may be affected by various factors such as market cycles, government policies, competition, innovation, etc.

Money Market Funds

A safer choice for short-term investments, money market funds invest in highly liquid, low-risk securities like treasury bills. These mutual fund investments provide stable returns and easy access to funds, suitable for those seeking liquidity and capital preservation.

Each type has its unique advantages, and choosing the right one can be a stepping stone to a successful investment journey.

NOTE- It is a must that you choose only after thoroughly comparing the benefits of mutual funds mentioned above.

How to Start Investing in Mutual Funds?

Investing in mutual funds is a smart way to grow your wealth in the stock market, and getting started is easier than you might think. Here’s a beginner-friendly step-by-step guide:

- Set Your Financial Goals: Determine your investment objectives, whether it’s saving for a dream vacation, retirement, or buying a house.

- Understand Risk and Return: Assess your risk tolerance to choose mutual funds that align with your comfort level. Remember, when investing in mutual funds, higher returns often come with higher risk.

- Research Mutual Funds: Explore different types of mutual funds in India and also thoroughly check the benefits of investing in mutual funds for all types, like equity, debt, or balanced funds. Look for past performance, expense ratios, and fund managers’ track records.

- Choose the Right Mutual Fund(s): Select mutual funds that rightly match your goals and risk tolerance. Portfolio Diversification is the ultimate key, so consider investing in a mix of funds.

- Complete KYC Process: Get your KYC (Know Your Customer) documents in order to comply with the regulatory requirements involved in mutual fund investments.

- Pick an Investment Method: Merely looking at the benefits of mutual funds is not the only way to choose your mutual fund in India. It is a must that you decide whether to invest through lump-sum payments or SIPs (Systematic Investment Plans) for regular mutual fund investments.

- Register with a Fund House: Open an account with a mutual fund company to start investing. You can also open a free DEMAT account with an online broker and start investing in mutual funds.

Looking for an app to invest in mutual funds? -Experience the benefits of zero brokerage trading now.

- Monitor and Review: Monitor your funds’ performance and review your portfolio regularly. Make adjustments as needed to stay on track with your goals.

Key Takeaways

- The benefits of Mutual funds are multiple, making them an attractive investment choice for achieving financial goals effectively.

- Mutual funds work like financial clubs, where people pool money to invest in diverse assets professionally managed by experts.

- The benefits of investing in mutual funds include diversification, professional management, accessibility, liquidity, affordability, and tax advantages.

- Professional management allows experienced fund managers to guide your investment journey, analysing trends and maximising returns.

- Diversification spreads investments across various assets, reducing overall risk and providing steady growth.

- Mutual funds in India offer an accessible gateway to the financial market, making investing easier for beginners.

- Quick liquidity is one of the pivot benefits of mutual funds that allows easy access, unlike traditional avenues like real estate.

- Another benefit of mutual funds is their affordability, as it enables you to start investing in mutual funds with small amounts through SIPs, witnessing steady growth over time.

- Tax benefits in mutual funds can save money while your investments grow, with options like ELSS for tax deductions.

- Mutual funds cater to various investment goals, offering a personalised investment journey based on risk tolerance and objectives.

- Compounding in mutual funds lets your money grow exponentially over time, creating long-term wealth.

- Types of mutual funds in India include equity, debt, balanced, index, tax-saving, sector-specific, and money market funds, each catering to different risk preferences and goals.

- Starting to invest in mutual funds is easy by setting financial goals, researching funds, choosing the right ones, completing KYC, and monitoring your portfolio regularly.

FAQ

There are multiple benefits of investing in Mutual funds, such as diversification, professional management, and liquidity, making them an attractive and effective option for long-term wealth growth in India.

Mutual funds pool money from investors to create a diversified portfolio of stocks, commodities and bonds. Skilled fund managers handle the investments on behalf of shareholders.

Yes, there are various types of mutual funds in India, like equity, debt, balanced, index funds, and more, each catering to different risk preferences and financial goals.

Yes, certain mutual funds like ELSS (Equity Linked Savings Schemes) provide tax benefits under Section 80C of the Income Tax Act, helping you save while you invest.

When investing in mutual funds in India, remember these key points: Avoid chasing quick gains, set clear investment goals, and don’t overlook expense ratios. Instead, focus on diversification and adopt a long-term approach for better results.

Begin by setting financial goals, researching funds, completing KYC, comparing the best mutual funds in India, and investing through SIPs or lump-sum payments through an online trading platform.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.