Are you considering investing but torn between mutual funds and stocks? To make a wise choice, let’s jump into the mutual fund vs. stock market debate today and explore the key differences.

The Rising Interest in Stocks and Mutual Funds

With the Indian stock market gaining popularity among both new and seasoned investors, it’s vital to understand the growing attraction.

Building Wealth: Mutual Funds or Stocks?

Achieving success as a self-reliant stock investor means you must understand companies, look at their financial statements, and follow market trends on your own.

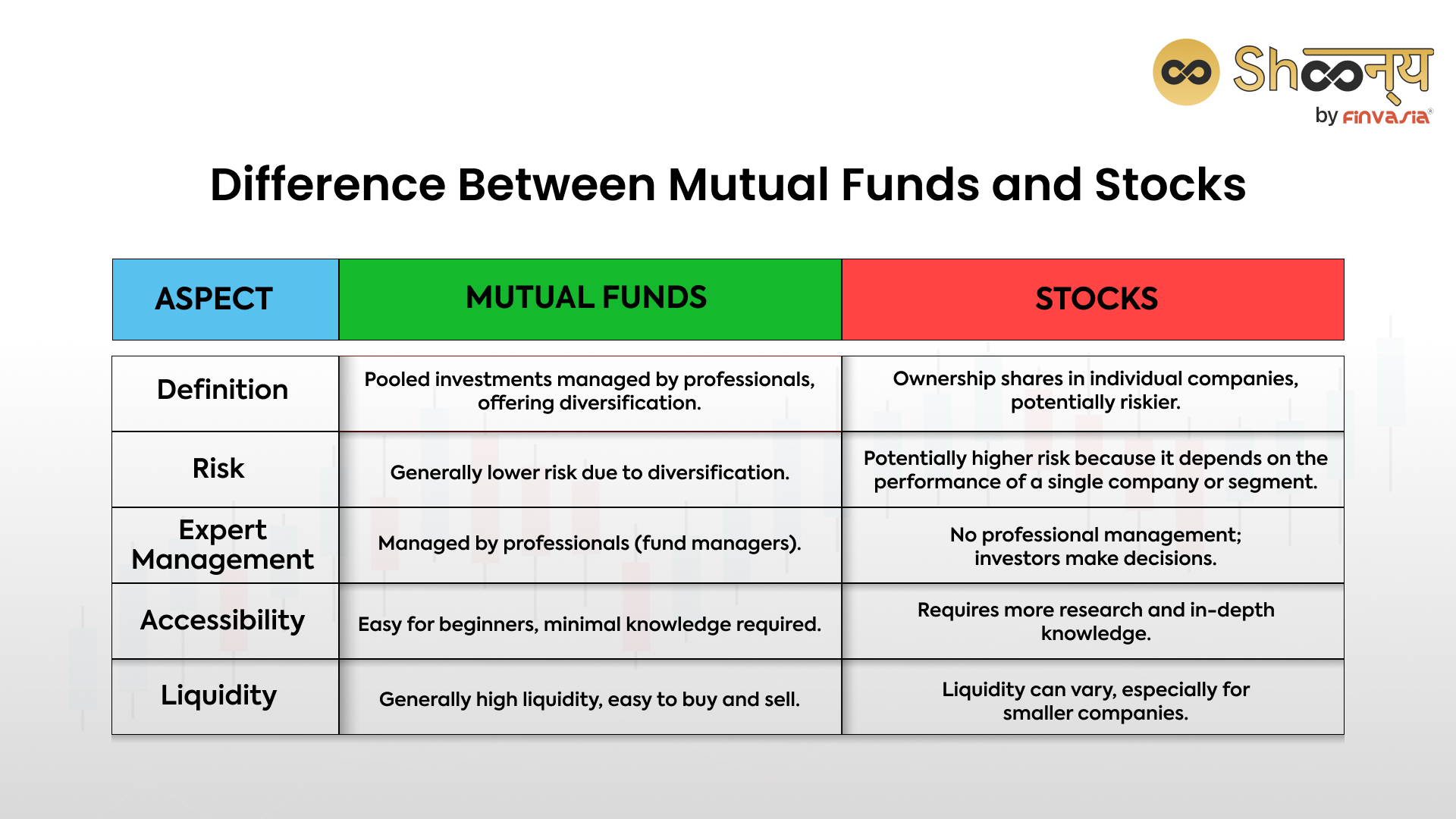

Mutual funds are investments managed by experts. They help spread the risk and are perfect for beginners who want an easy, hands-off approach.

Stocks mean you own a part of a single company. They could give you more profit, but they’re riskier. Deciding between them depends on how comfortable you are with risk, what you want to achieve, and how well you know finance. Your choice should match your goals and your knowledge.

Investing in Mutual Funds vs Stocks

The choice between investing in mutual funds or stocks depends on factors like investment goals, risk tolerance, and investor knowledge. Mutual funds suit those seeking diversified, low-risk, and long-term investments managed by professionals with ease of access. Stocks appeal to investors targeting individual companies, accepting higher risk and potential short-term returns but demanding research and analysis.

Mutual Funds vs Stock Market Returns

Mutual funds and stock market returns represent investment performance but are not directly comparable due to distinct characteristics.

Mutual funds comprise various securities professionally managed, offering diversification, lower risk, and convenience. However, they involve fees.

Stock market returns rely on individual stock performance, company, industry, economy, and investor skills and may vary based on risk and volatility.

Mutual Funds vs Stocks: Pros and Cons

- Mutual Funds Pros: Mutual funds offer diversification, professional management, accessibility for beginners, and regulatory oversight, ensuring transparency and compliance.

- Mutual Funds Cons: They involve costs like management fees and offer limited control. Prices are finalised at the end of the trading day, missing intraday opportunities.

- Stocks Pros: Stocks potentially yield higher returns, grant control and flexibility, and have lower trading costs.

- Stocks Cons: They entail more risk and necessitate in-depth knowledge, research, and emotional management due to market fluctuations.

The Mutual Fund Advantage

Commencing systematic investment plans (SIPs) with equity funds, including index funds, provides a solid introduction to the world of equities. SIPs allow you to distribute your investment cost over time, offering several advantages over direct stock investments.

Selecting the Right Mutual Funds

Investing in a mutual fund portfolio is reliable for pursuing specific financial goals. To help you decide on mutual fund categories based on your investment timeframes:

- Within a five-year timeframe: Consider debt mutual funds for short-term goals.

- Hybrid mutual funds balance growth potential and risk mitigation for a five-to-seven-year horizon.

- Beyond seven years: Equity mutual funds are ideal for long-term aspirations, capable of delivering superior returns.

Diversifying your portfolio with various mutual funds mitigates overall risk, increasing the likelihood of reaching your financial objectives.

Choose from 3000+ direct mutual funds and invest at zero-brokerage today!

Advantage of Stock Investments

Investing in stocks offers the advantage of potentially high returns. Stocks can yield significant profits over time, making them attractive to those seeking long-term wealth accumulation. However, they require research and a risk-tolerant approach, but the opportunity for financial growth makes them a popular choice among investors.

Choosing Your Investment Path: Mutual Funds or Stocks

The debate between stock market investing and mutual fund investments is ongoing and depends on several factors. Starting with mutual funds before gradually transitioning to stocks is recommended due to the market’s volatility. It’s a cautious approach to identifying companies and shares worth your risk, money, and time.

Both mutual funds and stocks offer investment opportunities, but a well-thought-out strategy tailored to your financial objectives and risk tolerance is key. Always seek professional advice for the best investment decisions.

Effective Asset Allocation

Asset allocation, distributing your investment portfolio across various asset classes, significantly impacts your long-term returns. The right asset allocation depends on your unique circumstances, risk tolerance, investment horizon, and financial goals.

Efficient Tax Management

Capital gains tax is a crucial consideration for those directly investing in stocks. This tax varies based on the asset’s holding period. Mutual funds have a tax-efficient structure, where gains or losses are distributed to unitholders according to their investments. This structure can be beneficial for long-term investors.

FAQs| Mutual Funds vs Stocks

Mutual funds provide diversification and are managed by professionals, offering convenience and regulatory protection.

Mutual funds reduce risk through diversification, skilled management, and cost-efficiency.

The choice depends on goals, risk tolerance, and expertise, with mutual funds offering lower risk and stocks providing the potential for higher returns.

The decision hinges on risk tolerance and preferences. Stocks offer higher returns but come with higher costs, while SIPs offer moderate returns with lower costs and convenience.

Mutual funds are considered safer than stocks due to diversification, economies of scale, asset growth through monthly contributions, and lower volatility.

Opting for mutual funds offers benefits like professional management, accessibility for beginners, and regulatory protection by SEBI.

Investing in mutual funds is less risky due to diversification across securities and professional management, while individual stocks expose investors to specific company risks.

Relying solely on picking individual stocks is risky because of delays in accessing information, unpredictable future events, and the higher investment risk associated with individual stock performance.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.