Portfolio Management Services (PMS) is a professional financial service that empowers investors in India to efficiently manage their equity portfolios with expert guidance. In this article, we will delve into the world of PMS, exploring its types, benefits, and why it’s a compelling option for Indian investors.

Understanding PMS- Portfolio Management Services

PMS service is a systematic approach that puts your equity investments on autopilot, allowing skilled portfolio managers and their research teams to handle the heavy lifting. This approach aims to maximize returns while mitigating risks, ensuring that your investments thrive even in a volatile market.

Types of Portfolio Management Services

1. Active Portfolio Management

In this approach, portfolio managers actively seek to maximise returns by diversifying your investments across asset classes, industries, and businesses. This proactive strategy results in higher turnover and aims to reduce risk.

2. Passive Portfolio Management

Passive management involves aligning your portfolio with current market trends. Portfolio managers often opt for index funds, which grow passively over time with minimal intervention, offering decent long-term returns and low turnover.

3. Discretionary Portfolio Management

Portfolio managers take the reins in this method. They tailor investment strategies based on your financial goals, risk tolerance, and investment horizon. For instance, they might recommend equity-oriented funds for risk-takers and debt-oriented funds for those who prefer safety.

4. Non-Discretionary Portfolio Management

In this approach, portfolio managers provide advice, but the final decision rests with you. Once you give the green light, they execute the recommended actions.

Types of PMS Investments

There are various types of Portfolio Management Services (PMS) investments, each catering to different preferences and objectives:

- Discretionary PMS: In this type, the PMS manager has complete authority to manage the portfolio without requiring the client’s approval for every decision.

- Non-discretionary PMS: Here, the PMS manager consults the client before making any investment decision, acting as an advisor.

- Equity PMS: This PMS primarily invests in equity-related securities, aiming for capital appreciation through market opportunities.

- Debt PMS: Debt PMS focuses on fixed income securities, aiming to generate regular income and preserve capital with low-risk investments.

- Hybrid PMS: A balanced approach, hybrid PMS invests in a mix of equity and debt securities, aligning with the client’s risk-return profile

Why Opt for Portfolio Management Services?

PMS is an excellent choice for you if:

- You possess a substantial net worth.

- You lack comprehensive knowledge about investments and their procedures.

- Your busy schedule prevents you from monitoring and rebalancing your investments.

- You are unfamiliar with market volatility and strategies to safeguard your investments during uncertain times.

- You seek diversification across various asset classes, such as stocks, debts, and equities.

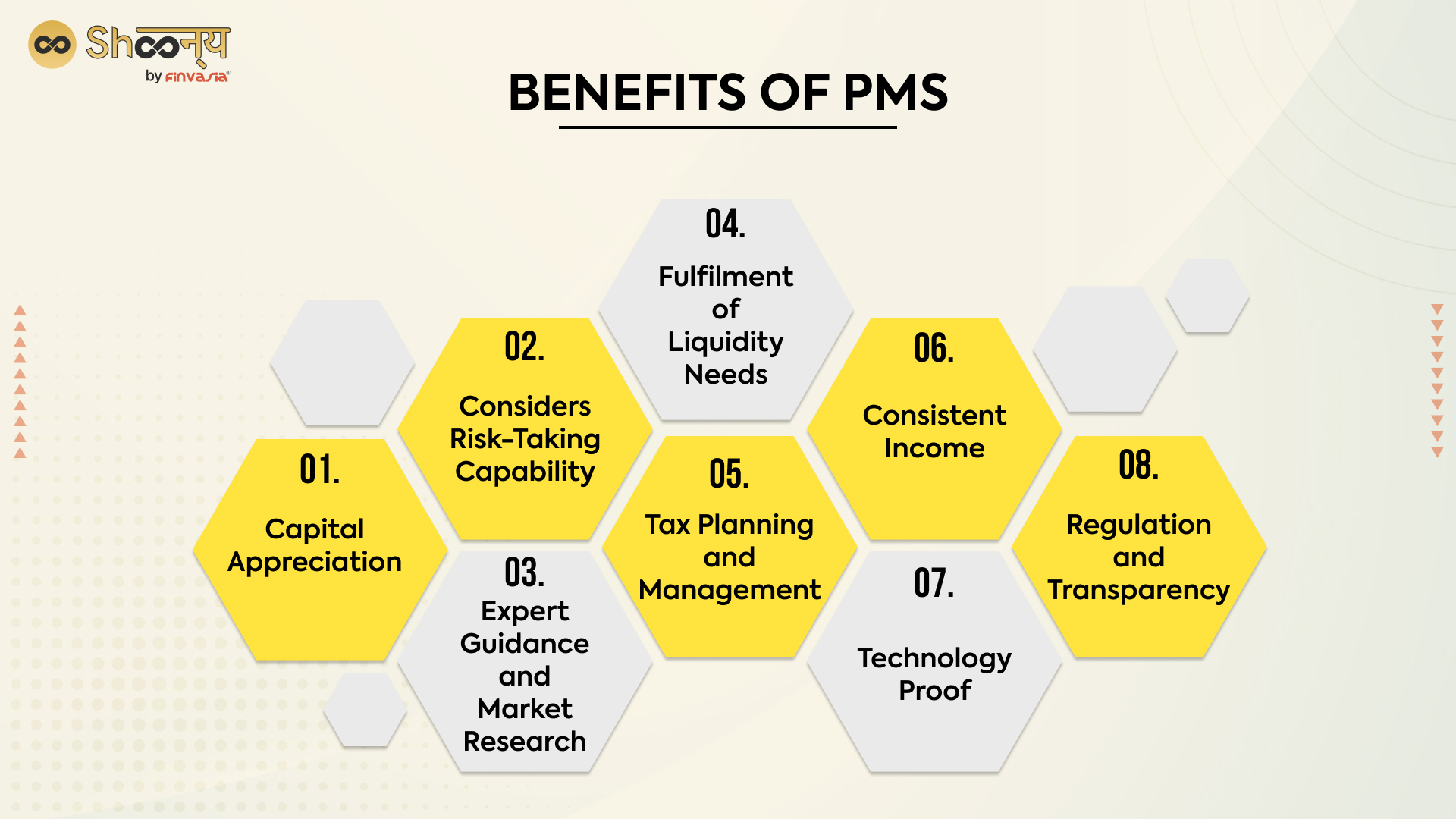

Portfolio Management Benefits: Advantages of PMS in India

Pay Less, Buy More

PMS offers an opportunity to invest efficiently, gaining exposure to a broader range of assets with less capital.

Premium Investment Vehicle

PMS focuses on delivering superior risk-adjusted returns. It relieves clients of the burden of constant monitoring, thanks to regular reviews and risk management. It is the ideal choice for high-net-worth investors in India.

Cashless Trading

Seasoned professionals with extensive experience in the equity markets manage your portfolio, following the communicated strategy.

Diversification of Risk

The stock market’s inherent volatility makes diversification crucial. PMS aims to reduce the impact of adverse events on your portfolio, shielding your investments from extreme market swings.

Scope for Higher Risk-Adjusted Returns

PMS typically maintains concentrated stock portfolios, increasing the potential for superior returns compared to the underlying index. This is especially true when the portfolio is adjusted to counter market volatility.

Expert Investment Opinion

PMS places your investments in the capable hands of professionals who excel in handling market volatility. Their expertise ensures efficient portfolio management, aiming to boost your profits over time.

Tailored Investment Plans

Portfolio managers create customized strategies based on your financial objectives, income, budget, risk tolerance, and age. These strategies adapt to meet your evolving needs.

Effective Risk Management

The primary goal of portfolio managers is to minimise your investment risk while maximizing returns. They achieve this by diversifying risk and protecting your portfolio from market fluctuations.

Regular Monitoring

Your portfolio manager keeps a watchful eye on each asset’s performance and returns. Using this data, they adjust your investment to align with your financial goals.

In conclusion, Portfolio Management Services (PMS) provide a reliable path for Indian investors, especially those with high net worth, to navigate the complexities of the financial market. By offering expert guidance, tailored strategies, and risk mitigation, PMS allows investors to unlock their wealth potential. Consider PMS as your trusted ally in achieving your financial goals and securing a prosperous future.

FAQs| Portfolio Management Services

Your choice depends on your risk tolerance and investment goals. Active management offers more potential for higher returns but comes with increased risk. Passive management aligns with market trends and is less risky but may yield moderate returns over time.

Yes, you can switch between PMS types to better align with your evolving financial objectives. Discuss your options with your portfolio manager for a seamless transition.

The minimum investment requirement varies among PMS providers in India. It typically ranges from ₹25 lakhs to ₹1 crore or more. Check with your chosen provider for specific details.

Portfolio reviews and updates frequency can vary, but they typically occur quarterly. However, some PMS providers may offer more frequent or customized reviews based on your preferences and market conditions.

Yes, PMS investments are subject to taxation in India. The tax treatment depends on factors such as the type of investment, holding duration, and applicable tax laws. Consult a tax expert for personalized guidance.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.