Before we differentiate between PMS (Portfolio Management Services) and Mutual Funds, let’s quickly understand what they are.

Portfolio Management Services- Registered professionals provide Portfolio Management Services. They often enter into an agreement with their client (investor) to construct an investment portfolio with the appropriate stock mix based on the client’s investment strategy and expectations. Portfolio Managers make customized investment decisions on behalf of their clients to achieve their objectives (income/return/risk).

Mutual Funds- Mutual funds are investment vehicles managed by professionals who allocate funds to maximize returns for fund investors. They are a collection of investments in securities such as bonds, stocks, money market instruments, etc. A mutual fund can be chosen based on one’s requirements and financial needs.

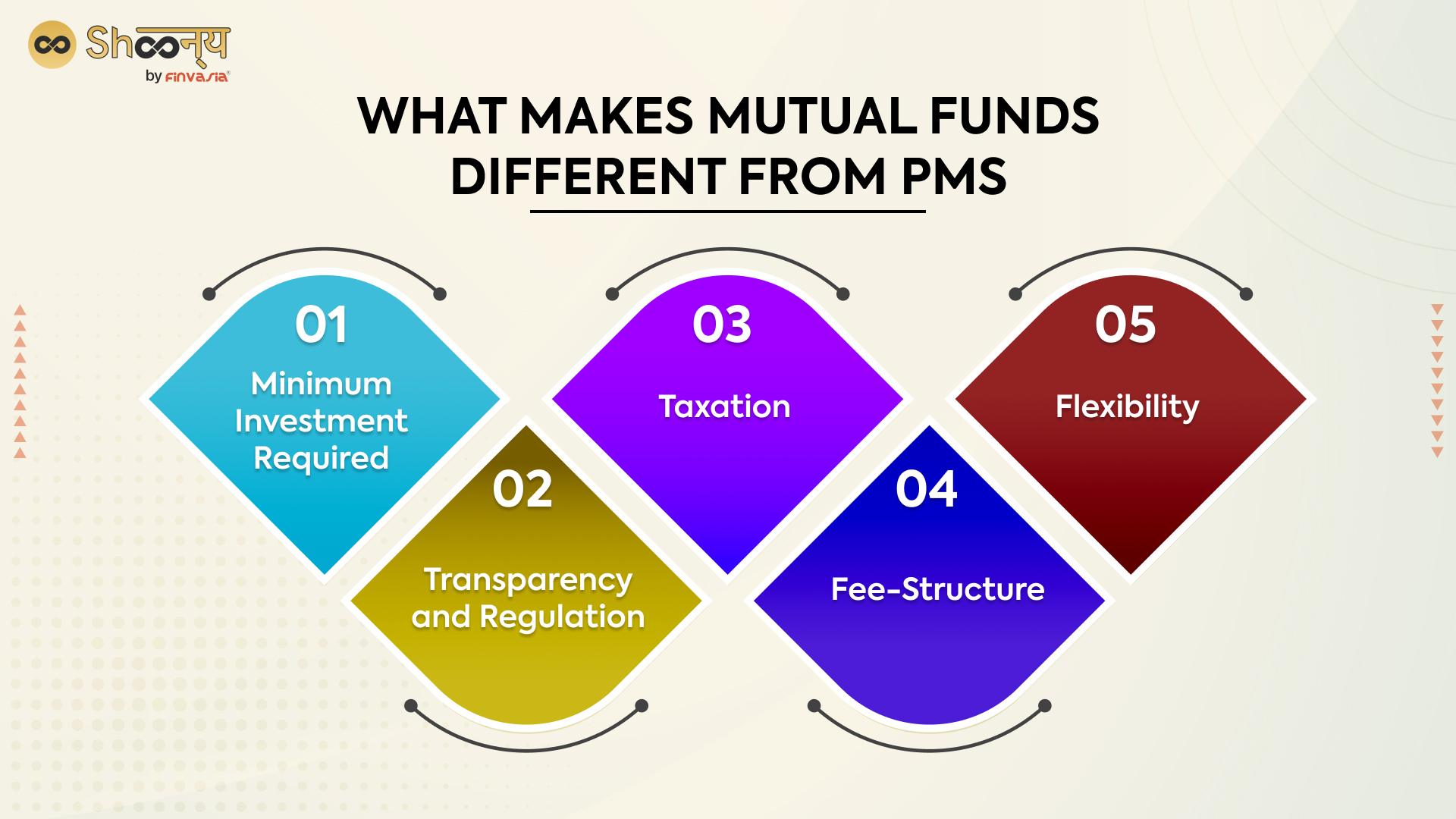

Portfolio Management Services and Mutual Funds are common choices among investors. We suggest you look at these differences and then decide for yourself.

- Minimum Investment Required:

PMS- According to SEBI, the portfolio manager must accept a minimum of Rs. 5 lakhs or securities worth a minimum of Rs. 5 lakhs from the client when opening an account to provide portfolio management services to the client. The minimum investment value, however, must be 25Lac.

Mutual Funds- You can start investing in mutual funds with as little as Rs 500.

- Transparency and Regulation:

PMS- As per SEBI, Portfolio Managers are required to issue full disclosure of money management which includes:

(a) the composition and the value of the portfolio, description of security, number of securities, value of each security held in the portfolio, cash balance and the aggregate value of the portfolio as of the date of the report;

(b) transactions are undertaken during the period of the report, including the date of the transaction and details of purchases and sales;

(c) beneficial interest received during that period in respect of interest, dividend, bonus shares, rights shares, and debentures;

(d) expenses incurred in managing the portfolio of the client;

(e) details of risk foreseen by the portfolio manager and the risk relating to the securities recommended by the portfolio manager for investment or disinvestment.

Mutual Funds– In the case of mutual funds, the investor receives a monthly final holdings report and a quarterly total expense ratio. However, before making an investment decision, we suggest you review the scheme performance of any mutual fund, as they are not subject to strict transparency.

- Taxation:

Mutual funds allow a fund manager to buy and sell stocks as often as he wants, and the transactions are tax-free.

In the case of PMS, however, the investor incurs capital gain or loss on every sale or purchase of stocks because the stocks are held in the investor’s name. As a result, the capital gains tax applies.

- Fee-Structure:

Portfolio Management services are much more expensive than mutual funds. Here is how their fee structure takes three shapes:

- Upfront fee: This fee is charged at the time of purchase, and the amount of the entry charge can range between 2% and 3%.

- Management fee: This is a mandatory quarterly portfolio management charge that can range between 1% and 3% depending on the provider’s terms.

- Performance fee: It accounts for the amount charged by the portfolio service provider as a performance fee on the portfolio. It acts like a profit-sharing ratio between the portfolio management service provider and the investor.

In the case of Mutual Funds, the fee is low as compared to PMS. Also, it follows a fixed payment system.

5. Flexibility:

PMS– You can make a tailor-made mix of the funds and a concentrated portfolio according to your needs and risk-to-reward capacity. It offers varied flexibility to investors.

Mutual Funds– Mutual Funds are not flexible. As per specific regulations, an investor can include a particular fund only up to a certain ratio in his portfolio.

Difference between MF and PMS

| Criteria | Mutual Fund | Portfolio Management Services (PMS) |

| Minimum Investment | Rs. 500 to Rs. 5,000 | Rs. 50 lakhs |

| Portfolio Customization | No | Yes |

| Fees and Charges | Lower | Higher |

| Regulatory Oversight | Higher | Lower |

| Tax Efficiency | Higher | Lower |

| Diversification | Higher | Lower |

| Liquidity | Higher | Lower |

| Transparency | Lower | Higher |

What should I choose?

PMS and Mutual Funds outperform the average rate of inflation growth, but mutual funds do not require a Demat account, whereas PMS requires one.

An investor invests in a mutual fund, and fund managers invest in the stock market, charging the investor through the expense ratio. However, in the case of PMS, an investor must hire a fund manager and give them power of attorney to invest in the stock market on the investor’s behalf.

Even though PMS provides greater flexibility, mutual funds are more tightly regulated and cost-effective; they are the preferred choice of investors to gain passive exposure to capital markets.

Final Words

Regarding pros and cons, we recommend that you conduct a comparative analysis based on your risk tolerance and expected return and then select your investment avenue.

FAQs

Both portfolio management and mutual funds aim to generate returns through investments, but they differ in several aspects. PMS offers customisation, transparency, flexibility, and direct accountability to investors, typically catering to high-net-worth individuals. Mutual funds are more accessible, tax-efficient, and diverse but lack customisation.

PMS providers offer various fee structures, including fixed fees, performance fees, and fund management fees. Mutual funds typically have fixed charges based on the amount of individual investment.

Yes, mutual funds offer the flexibility of starting with small investments, such as Rs. 500, through Systematic Investment Plans (SIPs).

Mutual funds are generally more tax-efficient, as they enjoy certain tax exemptions. In contrast, PMS investors are subject to capital gains tax.

Consider your risk tolerance, investment objectives, financial resources, and the level of customization you require when deciding between portfolio management and mutual funds.

Mutual funds pool money from investors and invest in a portfolio of assets. PMS offers customized investment solutions, managed by professionals based on individual needs.

No clear answer; PMS offers flexibility and transparency but requires higher investment, while MF offers diversification, liquidity, and tax benefits but with less control.

It’s selecting, monitoring, and optimizing a mutual fund’s securities by a fund manager to meet investors’ objectives and market conditions.

A fund is a pool of money managed by a professional, investing in a portfolio of assets. A portfolio can be self-managed or handled by a portfolio manager.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.