Sovereign Gold Bonds 2023: Your Easy Handbook to Interest Rates, Tax, and Maximum Limits

Are you looking for a safer and alternative way to invest your money in gold in 2023? Do you want to diversify your portfolio with an attractive option like gold but, also experience the benefit of hedge against inflation and currency fluctuations? If yes, then you should consider investing in sovereign gold bonds and government securities. These are two of the most popular and attractive investment options in India, offering multiple benefits to investors.

In this blog, we will take a look at the sovereign gold scheme by RBI and other government securities along with their features, benefits, and taxation.

Sovereign Gold Bonds – Meaning

Sovereign Gold Bonds are a special type of government securities denominated in grams of gold. This means that the investors do not receive physical gold, but a certificate that represents the amount of gold they have invested in. The investors have to pay the issue price in cash, and the bonds will be redeemed in cash on maturity. The Reserve Bank of India (RBI) issues these bonds on behalf of the Government of India as part of the Sovereign Gold Bond Scheme, which started in November 2015. Sovereign Gold Bonds Scheme lets people buy gold without actually having to keep it physically. This scheme was created to give people an option other than buying physical gold and to lessen the need for importing gold into the nation.

Eligibility Criteria for Investing in Sovereign Gold Bonds (SGBs)

- Residency:

- Persons classified as residents in India under the Foreign Exchange Management Act, of 1999 are eligible.

- Investor Types:

- Eligible investors encompass various categories:

- Individuals

- Hindu Undivided Families (HUFs)

- Trusts

- Universities

- Charitable institutions

- Eligible investors encompass various categories:

- Continued Holding for Non-Resident Investors:

- Individual investors who initially qualify as residents but experience a subsequent change in residential status to a non-resident can continue to hold SGBs until early redemption or maturity.

Features of Sovereign Gold Bonds (SGBs)

- Issued by RBI and Government of India: SGBs are issued by the Reserve Bank of India (RBI) on behalf of the Government of India under the Sovereign Gold Bond Scheme, aiming to provide an alternative to physical gold.

- Denominated in Grams: Bonds are denominated in grams of gold, with one gram as the basic unit. The minimum investment is one gram, and the maximum is four kilograms per individual per fiscal year.

- Fixed Interest Rate: SGBs pay a fixed interest rate of 2.5% per annum on the nominal value, given semi-annually. The interest is taxable as per the Income Tax Act, of 1961, but there is no Tax Deducted at Source (TDS) on interest payments.

- Linked to Gold Market Price: The bonds’ issue and redemption prices are tied to the market price of gold, based on the average closing price of 999 purity gold.

- Paper or Demat Form: SGBs are issued in paper or demat form and can be bought and sold through various channels, including banks, post offices, stock exchanges, and designated agents.

- Government Backing and Collateral: Backed by the Government of India, SGBs are considered a secure investment. They can also serve as collateral for loans from banks and other financial institutions.

- Listed on Stock Exchanges: SGBs are listed on stock exchanges, allowing investors to exit them at any time.

- Maturity and Redemption Options: All gold bonds have an 8-year maturity, with the option of premature redemption after 5 years. This provides flexibility to investors.

- Capital Gains Tax: If bonds are sold within 3 years, STCG will be applicable. However, above 3 years, LTCG will apply.

Understanding Sovereign Gold Bonds Scheme in Detail

Here’s how the Sovereign Gold Bond Scheme works:

- The sovereign gold bonds are measured in grams of gold, starting from one gram as the smallest amount. People can invest anywhere from one gram to four kilograms per individual each fiscal year. The bonds last for eight years, but you can choose to leave the scheme after the fifth year.

- These bonds pay a fixed interest rate of 2.5% every year on the initial value, given out twice a year. Although this interest is taxable based on the Income Tax Act of 1961, there’s no Tax Deducted at Source (TDS) on the interest payments.

- The bond prices depend on the current market price of gold. The starting and ending prices are determined by the average closing price of 999 purity gold, as published by the India Bullion and Jewellers Association (IBJA) during the three working days before the subscription or redemption dates.

- You can get these bonds in paper or digital form and buy or sell them through banks, post offices, stock exchanges, and other authorized agents. They’re also allowed to be traded on stock exchanges within two weeks of being issued.

Sovereign Gold Bonds: Maximum Limit To Invest

The maximum limit for investment in Sovereign Gold Bonds depends on the type of investor:

- For individuals and Hindu Undivided Families (HUFs), the upper limit is 4 kilograms of gold. The minimum investment starts at 1 gram.

- Entities like trusts and universities have a higher permissible limit, allowing them to invest up to 20 kilograms of gold in Sovereign Gold Bonds.

Sovereign Gold Bonds Interest Rate

The interest rate for Sovereign Gold Bonds is fixed at 2.5% per year on the original amount you invested. This interest is paid twice a year.

Tax on Sovereign Gold Bonds

When it comes to taxes:

- If you keep the bonds until they mature (complete the full eight years), you won’t have to pay capital gains tax on the money you make.

- The gains from selling or transferring the bonds before maturity are taxable based on the applicable rules. However, there’s a benefit called indexation available for long-term capital gains.

- These bonds are backed by the Government of India, making them a secure investment. Plus, you can use them as collateral for loans from banks and other financial institutions.

In summary, the Sovereign Gold Bond Scheme is great for people who want to invest in gold without dealing with the hassle of physically holding, moving, or verifying its purity. It provides a steady income, potential for profit, tax advantages, and easy access to your money. Additionally, the scheme helps the country by reducing the current account deficit and saving foreign exchange.

What is a Government Security (G-Sec)?

A Government Security (G-Sec) is a tradeable instrument issued by the Central Government or the State Governments, acknowledging the Government’s debt obligation. These securities can be short-term, such as treasury bills with original maturities of less than one year, or long-term, like Government bonds or dated securities with original maturities of one year or more.

In India, the Central Government issues both treasury bills and bonds or dated securities, while State Governments issue bonds or dated securities known as State Development Loans (SDLs). G-Secs are considered practically risk-free gilt-edged instruments with no default risk.

a. Treasury Bills in India

Treasury bills or T-bills are short-term debt instruments issued by the Government of India, categorized as money market instruments. They come in three tenors: 91 days, 182 days, and 364 days. T-bills are zero-coupon securities, meaning they pay no interest. Instead, they are issued at a discount and redeemed at face value at maturity. For instance, a 91-day Treasury bill with a face value of ₹100 may be issued at ₹98.20, redeemed at the face value of ₹100. The return to investors is the difference between the maturity value and the issue price.

b. Cash Management Bills (CMBs)

Introduced in 2010, Cash Management Bills (CMBs) are short-term instruments similar to T-bills. They were introduced to address temporary mismatches in the cash flow of the Government of India and have maturities of less than 91 days.

c. Dated G-Secs

Dated G-Secs are securities with a fixed or floating coupon (interest rate) paid on the face value, on a half-yearly basis. The tenor of dated securities typically ranges from 5 years to 40 years.

Why should one invest in G-Secs?

Holding excess cash or investing in gold may not yield returns or present practical challenges. Investing in G-Secs offers several advantages:

- G-Secs provide a return in the form of coupons and offer maximum safety due to the Sovereign’s commitment to payment of interest and repayment of principal.

- They can be held in book entry or physical form, offering flexibility.

- Available in maturities from 91 days to 40 years, G-Secs suit various liability structures.

- G-Secs can be easily sold in the secondary market to meet cash requirements.

- They can be used as collateral to borrow funds in the repo market.

- Securities like SDLs and Special Securities provide attractive yields.

- The settlement system for G-Secs, based on Delivery versus Payment (DvP), is simple, safe, and efficient.

- G-Sec prices are readily available due to a liquid and active secondary market with transparent price dissemination.

- Besides banks and insurance companies, smaller investors like Cooperative banks, Regional Rural Banks, and Provident Funds are required to statutorily hold G-Secs

State Development Loans

State development loans (SDLs) are dated securities issued by the state governments to fund their market borrowings requirements. They are similar to the central government securities in terms of issuance, trading, settlement, and taxation. However, they differ in terms of credit risk, interest rate, and spread.

SDLs carry a higher credit risk than G-secs, as they depend on the fiscal health and repayment capacity of the state governments. Therefore, they offer a higher interest rate than G-secs of the same maturity. The interest rate differential or spread between SDLs and G-secs reflects the market perception of the relative credit risk of the state governments. SDLs are issued through auctions conducted by the RBI on a fortnightly basis. They are traded in the secondary market through various platforms and are also used as collateral for loans.

FAQs| Sovereign Gold Bonds- 2023

Yes, a sovereign gold bond (SGB) is a government bond issued by the Reserve Bank of India (RBI) on behalf of the Government of India. It is linked to the price of gold, pays a fixed 2.5% interest per annum, and has an 8-year maturity.

Investing in sovereign gold bonds has advantages, including government backing, a fixed interest rate, and exemption from TDS on interest income. They also eliminate storage costs and risks associated with physical gold, are easily tradable, and can be used as loan collateral.

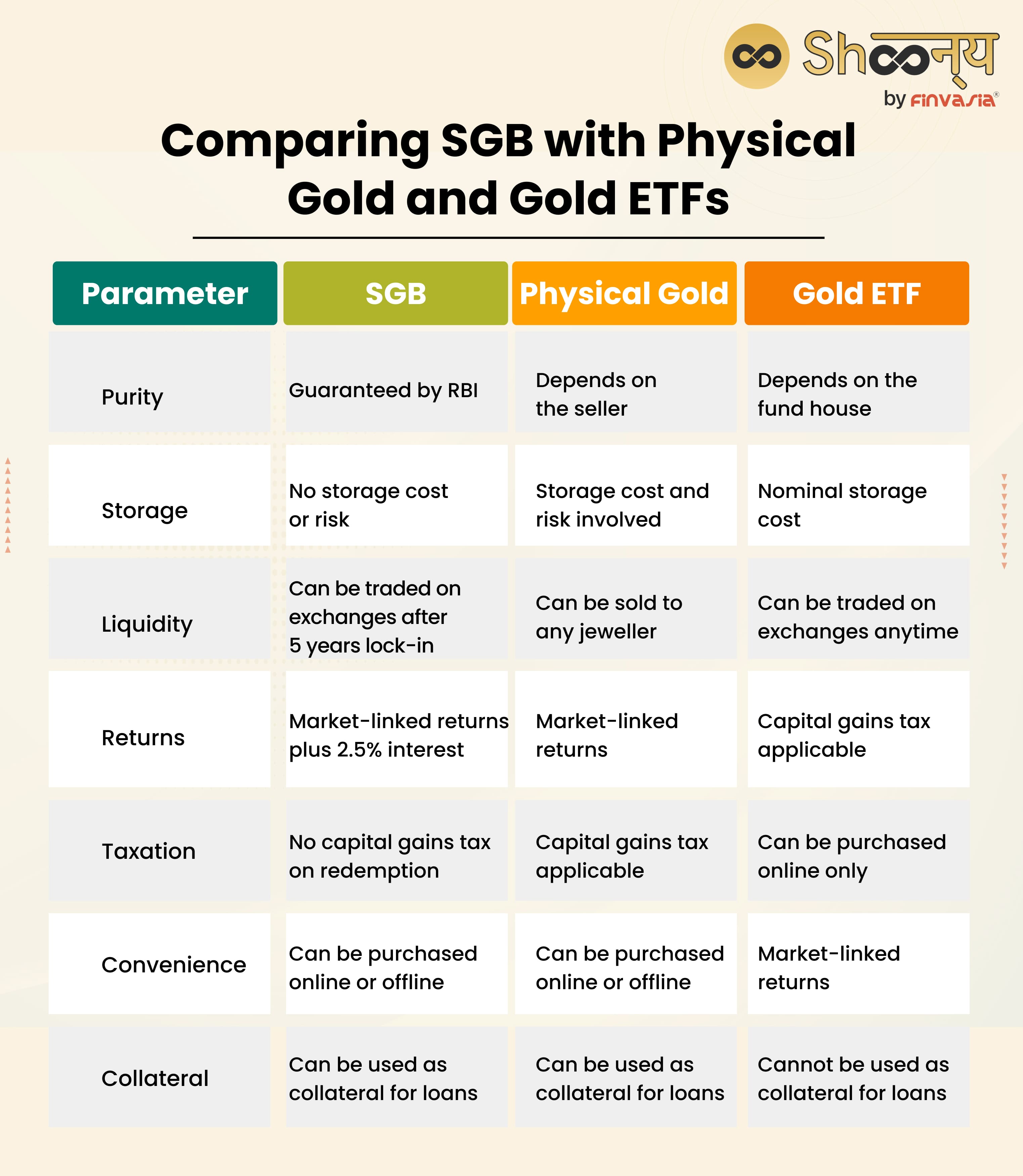

Choosing between physical gold and Sovereign Gold Bonds (SGB) depends on your preferences and financial goals. Physical gold offers higher liquidity but comes with storage concerns and capital gains tax. On the other hand, SGB provides safety, a fixed interest rate, and tax advantages, but it has a lock-in period and limited availability. You must consider factors like liquidity, returns, safety, taxation, and availability before making a choice.

Source– rbi.org.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.