As investors, we often have different priorities. Some look for ways to earn a lump sum, while others look for ways to earn regular returns. Do you belong to the second category? By regular intervals, we mean monthly, quarterly, or yearly from your initial investment amount. When we talk about investing in small amounts, we all know about SIP- a Systematic Investment Plan in mutual funds. But, when it comes to a similar method that lets you withdraw at regular intervals, i.e. SWP (Systematic Withdrawl Plan) in mutual funds.

Now, what is SWP in Mutual Fund

Let us take a look!

- What is SWP in Mutual Fund?

- SIP vs SWP| How Do They Differ?

- Key Features of Systematic Withdrawal Plans

- Types of Systematic Withdrawal Plan

- How Does a Systematic Withdrawal Plan Work?

- Benefits of Investing in a Systematic Withdrawal Plan

- Key Considerations for Investing in Systematic Investment Plans in Mutual Funds

- Conclusion

What is SWP in Mutual Fund?

SWP full form is a Systematic Withdrawal Plan.

Systematic Withdrawal Plans (SWPs) are a tool in the Indian stock market that allows investors to withdraw a fixed amount regularly from their mutual fund investments. It provides a steady income stream while keeping the investment intact.

Generating Monthly Income through Mutual Funds

Many people invest in Mutual Funds to secure a regular income. They often consider receiving dividends as an option. Therefore, many schemes, especially those focused on debt, offer monthly or quarterly dividend options.

Another way to obtain a monthly income is by utilising the Systematic Withdrawal Plan (SWP). In this method, investors need to invest in a scheme’s growth plan and specify a fixed amount required as a monthly payout.

How Does a Systematic Withdrawal Plan Work?

Now that you know about a systematic withdrawal plan is, let’s see how it operates with an example.

Imagine you’ve invested Rs. 1,50,000 in a mutual fund and want to withdraw a fixed amount each month to maintain a steady income stream.

So, you opt for a SWP in a mutual fund and choose to withdraw Rs. 6000 on the 5th of every month. The mutual fund’s Net Asset Value (NAV) stands at Rs. 25 per unit.

When you set up a systematic withdrawal plan (SWP), you direct the fund house to transfer funds to your bank account at regular intervals, typically monthly, quarterly, or annually.

Now, you also have to instruct the fund house to release funds at regular intervals. As said, you can choose among monthly, quaretely, or yearly.

Therefore, these funds get transferred to your bank account

SWP in mutual funds is the most effective way to earn regular income. It gives you the freedom to withdraw your money in a planned manner. Usually, it is on a monthly basis.

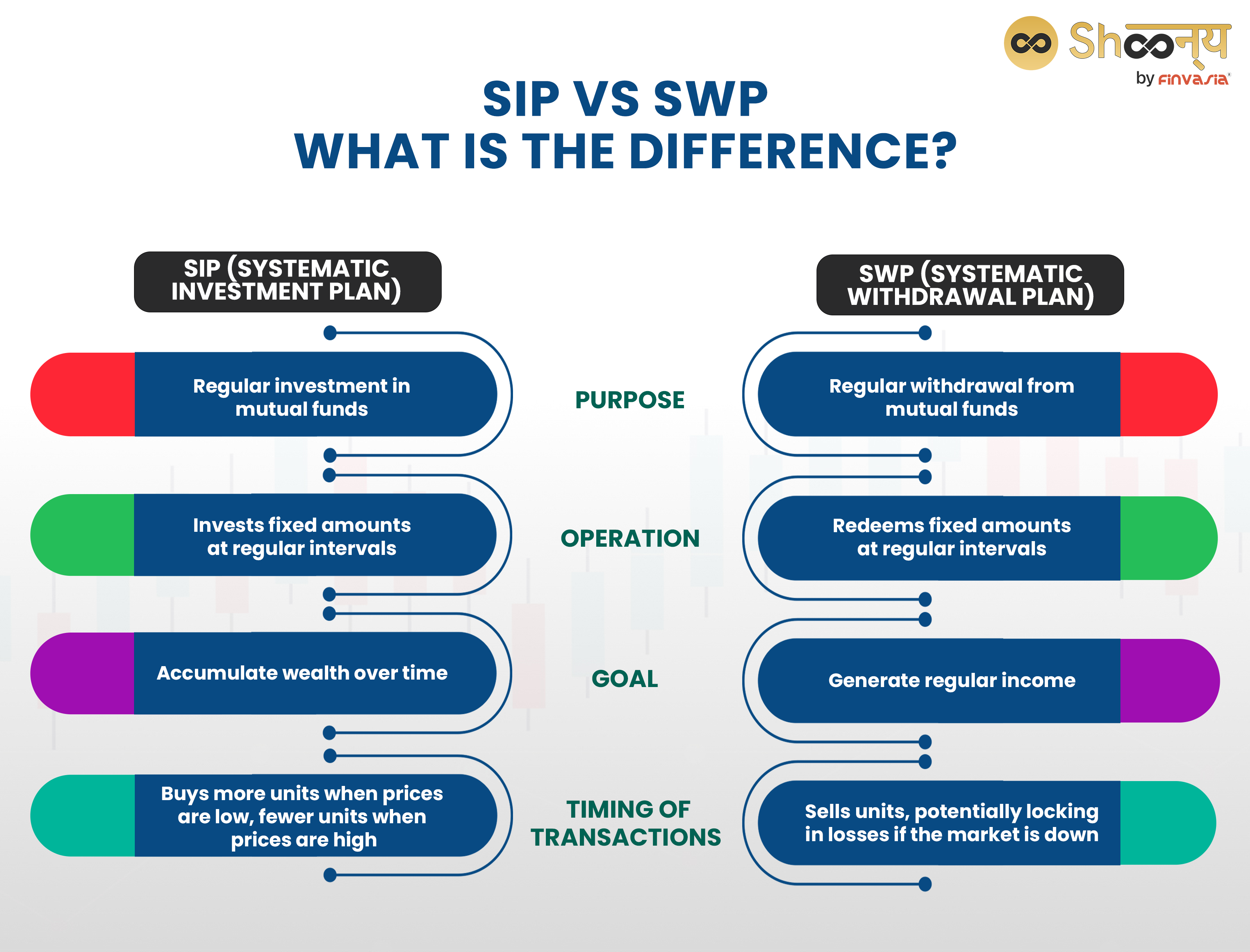

SIP vs SWP| How Do They Differ?

Systematic Investment Plan (SIP) and Systematic Withdrawal Plan (SWP) are both methods used in mutual fund investing.

They’re similar in that they involve regular transactions (investing in SIP, withdrawing in SWP) at fixed intervals.

SIP involves investing fixed amounts regularly to build wealth over time.

However, SWP involves withdrawing fixed amounts regularly to create a steady income stream from accumulated investments.

Know the differences between SIP (Systematic Investment Plan) and SWP (Systematic Withdrawal Plan):

SIP vs SWP: What is the difference?

| Feature | SIP (Systematic Investment Plan) | SWP (Systematic Withdrawal Plan) |

| Purpose | Regular investment in mutual funds | Regular withdrawal from mutual funds |

| Operation | Invests fixed amounts at regular intervals | Redeems fixed amounts at regular intervals |

| Goal | Accumulate wealth over time | Generate regular income |

| Timing of transactions | Buys more units when prices are low, fewer units when prices are high | Sells units, potentially locking in losses if the market is down |

Key Features of Systematic Withdrawal Plans

SWP in mutual funds have some unique character traits:

- Systematic Withdrawal Plans (SWPs) offer investors the freedom to withdraw a fixed sum every month.

- SWPs are crucial for retirement planning, income management, and ensuring peace of mind for investors.

- With SWPs, investors can tailor withdrawal amounts, frequencies, and durations to their needs.

- SWPs are suitable for retirees or those with significant investment portfolios.

- Careful planning is essential for SWPs, considering factors like financial goals, risk tolerance, and tax implications.

- You can combine SWPs with NPS and mutual funds for a well-rounded investment strategy.

- Aggressive hybrid funds and balanced advantage funds offer a blend of equity and debt for various risk profiles.

Suitability of Systematic Investment Plans

If you have the following goals in mind, SWP in mutual fund might be for you:

- Individuals seeking regular income from their investments.

- Retirees looking to supplement their pension or other income sources.

- Investors with a long-term investment horizon want to manage their cash flows efficiently.

- Those aiming to diversify their income sources and reduce reliance on traditional fixed-income instruments.

- Individuals who prefer a systematic approach to withdrawing funds from their investments.

- Investors seek tax-efficient ways to generate income from their investments.

Types of Systematic Withdrawal Plan

Below are the various types of systematic withdrawal plans that you must know:

- Fixed Withdrawal SWP: Withdraws a fixed amount at regular intervals, providing a predictable income stream.

- Capital Appreciation SWP: Withdraws only the gains earned on the investment, allowing the principal amount to remain invested for potential growth.

- Growth SWP: Allows investors to withdraw a predetermined percentage of the portfolio value periodically, maintaining the potential for portfolio growth.

- Dividend SWP: Distributes dividends earned from mutual fund investments at regular intervals, providing income to investors.

- Flexible SWP: Offers the flexibility to adjust withdrawal amounts and intervals according to changing financial needs and market conditions.

How Does a Systematic Withdrawal Plan Work?

When you opt for an SWP, you’re essentially redeeming a part of your mutual fund units at the current Net Asset Value (NAV). The amount you receive will depend on the NAV of the units at the time of withdrawal.

Instead of withdrawing a lump sum in one go, which could potentially disrupt your investment strategy, SWP lets you withdraw a fixed sum periodically.

Here’s a breakdown of how a systematic withdrawal plan operates:

- As an investor, you can choose which mutual fund scheme you want to invest in before starting an SWP.

- Now, you must decide whether to invest through SIP or lump sum.

- Next, set an SWP and instruct the fund house on how frequently you want to withdraw money.

- You can decide and specify the amount you want to withdraw with each SWP instalment.

- The amount withdrawn remains invested in the chosen mutual fund scheme. Therefore, the performance of the market and the mutual fund scheme can affect the remaining investment value.

- On the withdrawal date, the fund house sells your mutual funds to meet the specified withdrawal amount and credits the amount to your bank account.

- This redemption process continues for the specified period or until you terminate your SWP.

- The remaining balance in your fund continues to generate returns based on underlying asset performance. As you withdraw money through SWPs, your account balance gradually decreases over time.

Benefits of Investing in a Systematic Withdrawal Plan

Let us know why you should invest in SWP in mutual funds:

- Regular Income

SWP (Systematic Withdrawal Plan) provides a steady stream of income to investors by periodically redeeming units from their mutual fund investments. - Flexibility

Investors have the option choose the frequency and amount of withdrawals according to their financial needs.

- Potential for Growth

While providing regular income, the remaining invested amount has the prospect to grow over time, depending on the performance of the mutual fund.

- Diversification

Investors can diversify their SWP across different mutual funds to spread risk and potentially enhance returns.

- Convenience

SWP offers a hassle-free way to receive income without the need for constant monitoring or manual intervention, making it convenient for investors.

Key Considerations for Investing in Systematic Investment Plans in Mutual Funds

Here are some common things that you must know about SWP in mutual funds:

- You must consider your financial goals and purpose for the SWP scheme.

- Evaluate the track record and consistency of returns of the chosen mutual funds for SWP, along with associated fees.

- Opt for monthly SWP for regular income or lump-sum withdrawal for flexibility.

- Choose SWP options to enhance retirement corpus size if planned strategically.

- Check exit load and expense ratio for potential impact on SWP returns.

- Understand tax implications including capital gains tax and dividend distribution tax, selecting tax-efficient funds to maximize returns.

Conclusion

In India, the interest rates for Systematic Withdrawal Plans (SWP) have recently gained significant attention. This surge is primarily due to the appeal of steady returns offered by SWP. Investors are actively engaging with SWP, attracted by its simplicity and the promise of stable growth. The allure of SWP interest rates lies in their reliability and potential for consistent earnings over time. As a result, investors are every day attracted to SWP in India, reflecting a growing preference among investors for active income generation strategies.

FAQs| SWP

SWP can offer more flexibility and potentially better tax efficiency compared to FD, making it a suitable choice for regular income needs.

Yes, a systematic withdrawal plan is good for generating a steady income stream, especially for retirees or those seeking regular payouts from their investments.

For a 5-year period, choosing SWP funds that balance risk and return, such as hybrid or debt funds, is recommended for consistent income.

SIP is ideal for building wealth over time through regular investments, while SWP is better for those seeking regular income from their accumulated investments.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.