Are you looking for an effective investment plan that enhances your wealth and also provides a safety net? Unit Linked Insurance Plans (ULIPs) are the answer for the ambitious yet cautious. These plans blend the growth potential of market investments with the stability of insurance coverage. Thus solving a dual-purpose dilemma for the modern investor. With ULIPs, you’re not just investing. You’re securing a foundation with a smart plan that offers insurance and investment.

Let us understand the Unit Linked Insurance Plans (ULIPs) in detail.

- What is the ULIP Policy?

- Benefits of ULIP (Unit Linked Insurance Plan)

- Cons of Investing in ULIPs (Unit Linked Insurance Plans)

- Cost Considerations of ULIP Policy

- Key Differences Between Mutual Funds and ULIPs

- Why Should You Choose ULIP (Unit Linked Insurance Plan)

- What are Some Common Myths about ULIPs

- Is ULIP Good or Bad?

- FAQs|Unit Linked Insurance Plan

What is the ULIP Policy?

ULIP stands for Unit Linked Insurance Plan. It’s a type of insurance policy that offers both insurance coverage and investment opportunities in one product.

When you buy a ULIP policy, a portion of your premium goes towards providing life insurance coverage.

However, the company invest the remainder in funds of your choice. This could be equity, debt, or balanced funds.

What is so unique about the ULIP policy?

The unique thing about Unit Linked Insurance Plans is that they allow you to decide how your money is invested. This means you can choose funds that align with your financial goals and risk tolerance. The value of your ULIP investment depends on the performance of these chosen funds.

ULIPs offer flexibility, too.

You can switch between different funds based on market conditions or your changing financial needs.

What about tax?

Unit Linked Insurance Plans usually come with tax benefits, like deductions on the premium paid and tax-free returns.

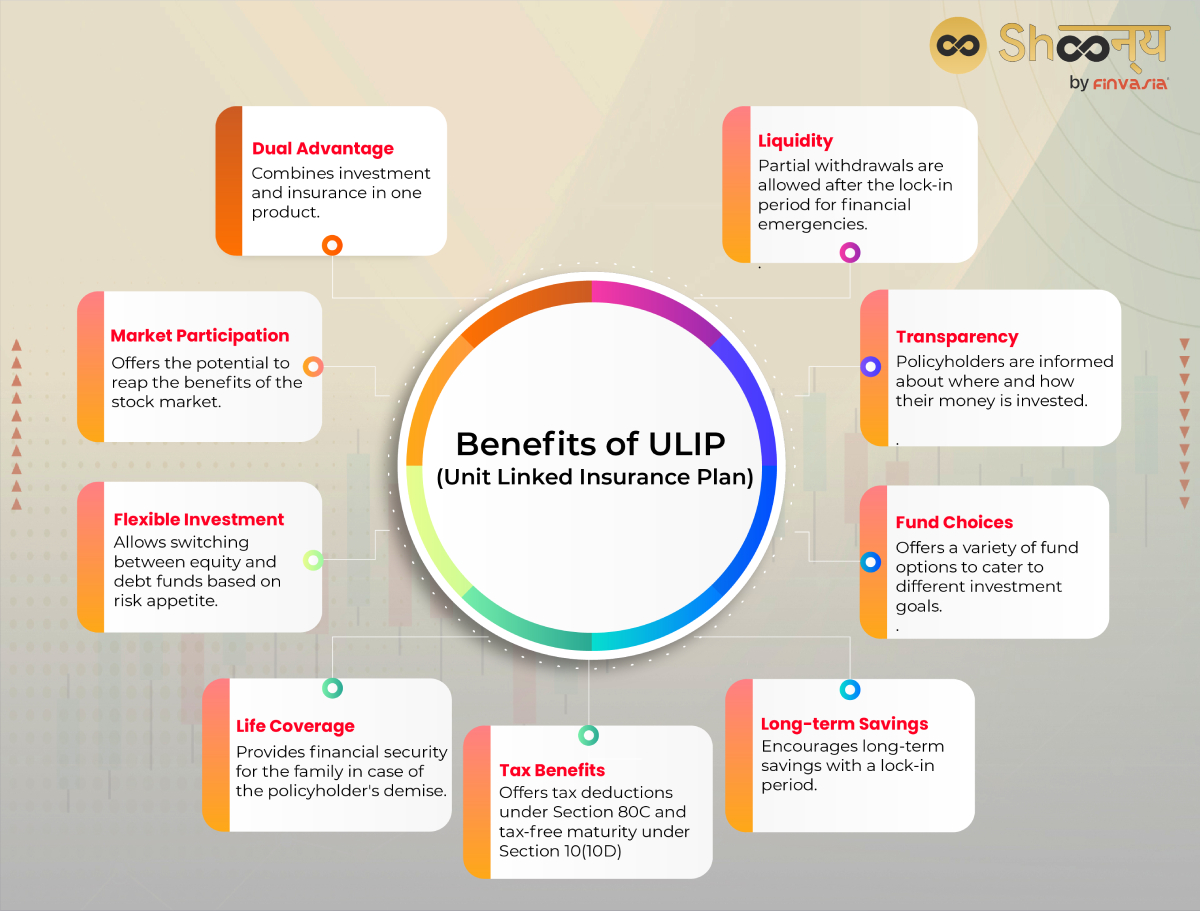

Benefits of ULIP (Unit Linked Insurance Plan)

- Insurance Protection

Unit Linked Insurance Plan offers life insurance coverage, ensuring financial protection for your loved ones in case of your unfortunate demise.

- Investment Flexibility

ULIP policy allows you to choose from different fund options on the basis of your risk appetite and financial goals, such as equity funds for higher returns or debt funds for stability.

- Market-linked Returns

The investment component of ULIPs offers the potential for market-linked returns, enabling you to benefit from equity market growth over the long term.

- Transparency

ULIPs provide transparency regarding investment performance and charges.

Cons of Investing in ULIPs (Unit Linked Insurance Plans)

- Charges and Fees

ULIPs have various charges like premium allocation fees, fund management fees, mortality charges, and policy administration fees, which can lower investment returns.

- Market Risks

Market changes may affect the overall performance of unit linked insurance plans.

- Complexity

ULIPs can be complex to understand due to the different charges and allocation of funds for insurance and investment.

- Lock-in Period

The unit linked insurance plan typically has a lock-in period of 5 years, during which withdrawing funds may result in charges.

Cost Considerations of ULIP Policy

While ULIPs offer attractive benefits, it’s important to understand the associated costs. ULIPs typically have charges like Fund Management Charge (FMC) and Mortality Charge.

The addition of the Waiver of Premium (WOP) feature incurs an extra charge, impacting the net return on investment.

However, modern unit linked insurance plan has a simplified fee structure, making it more transparent and investor-friendly.

Do ULIPs sound similar to mutual funds?

They might. However, there is a huge difference between both!

Let’s take a look!

Key Differences Between Mutual Funds and ULIPs

| Feature | Mutual Funds | ULIPs (Unit Linked Insurance Plans) |

| Purpose | Investment and wealth creation | Combined insurance coverage and investment |

| Insurance Coverage | No insurance coverage | Provides life insurance coverage along with investment |

| Structure | Pure investment product | Combines insurance and investment into a single plan |

| Cost Structure | The expense ratio, potential exit loads | Multiple charges, including premium allocation, fund management, etc. |

| Tax Treatment | Gains subject to capital gains tax, dividends taxable | Tax benefits on premiums paid (under Section 80C) and maturity proceeds (under Section 10(10D)) |

| Flexibility | Offers flexibility in fund selection and switching | Allows flexibility in choosing funds and switching between them based on market conditions |

Why Should You Choose ULIP (Unit Linked Insurance Plan)

Boost Your Financial Immunity with ULIPs

Unit Linked Insurance Plan (ULIP) is a versatile financial tool to secure their future goals.

Here’s why ULIPs can enhance your financial portfolio:

Investment and Insurance Combined

ULIPs allow you to invest in equity, debt, or a mix of both while providing life insurance coverage. This dual benefit helps you grow your wealth alongside securing your family’s financial future.

Continuity of Investment Goals

One standout feature of ULIPs is the Waiver of Premium (WOP).

Now, what does this mean?

It ensures that your long-term investment objectives remain intact even if something unfortunate happens to you.

In the event of the policyholder’s demise, the WOP feature waives off all future premium payments, keeping your investments active.

Long-Term Financial Planning

Are you looking for some long term plans such as saving for a house, or, are you worried about funding your own retirement?

The combination of investment opportunities and life cover makes ULIPs a comprehensive solution!

TAX Benefits Offered By ULIP

Unit Linked Insurance Plans (ULIPs) offer several tax benefits under the Indian Income Tax Act.

- Premiums paid towards a ULIP qualify for a tax deduction under Section 80C. This deduction can reduce your taxable income.

- Maturity proceeds from a ULIP are exempt from income tax under Section 10(10D), provided the annual premium does not exceed ₹2.5 lakh.

- For ULIPs issued after February 1, 2021, if the annual premium exceeds ₹2.5 lakh, the returns are subject to Long-Term Capital Gains (LTCG) tax at 10% on gains above ₹1 lakh.

Please remember that these tax benefits may change with amendments to the law.

How Does the Waiver of Premium (WOP) feature in a Unit-Linked Insurance Plan (ULIP) work?

The WOP feature in ULIPs safeguards both your investment and insurance benefits. In case of the policyholder’s untimely demise, the insurance company pays out the higher value between the life cover or fund value.

With WOP, your investments continue to grow even after the policyholder’s demise, ensuring financial security for your beneficiaries.

What are Some Common Myths about ULIPs

- High Risk

One myth is that Unit Linked Insurance Plans are very risky because of the equity component. However, ULIPs offer various fund options, including less risky debt funds.

- Life Cover Depends on Market Performance

Some believe that the life cover in ULIPs fluctuates with market conditions. In reality, the life cover remains fixed and is not impacted by market changes.

- Poor Returns

There’s a misconception that ULIPs don’t yield good returns. However, returns depend on the underlying asset class performance. You can certainly reduce the risk element through fund selection and timely switching.

- Lack of Liquidity

It’s wrongly assumed that ULIPs have no liquidity. While there’s a lock-in period, it allows partial withdrawals afterwards, providing some liquidity.

- No Sum Assured

Another misconception is that Unit Linked Insurance Plans don’t offer a sum assured.

ULIPs do provide a sum assured, which is the minimum guaranteed amount to the beneficiary upon the policyholder’s demise.

Now comes the main question!

Is ULIP Good or Bad?

The suitability of ULIPs depends on individual financial goals, risk tolerance, and investment horizon. Unit Linked Insurance Plans can be beneficial for individuals seeking both insurance coverage and investment growth. However, it’s essential to understand the associated costs and risks, such as fund management charges and market fluctuations.

ULIPs can be advantageous for long-term investors who are comfortable with market-linked returns.

FAQs|Unit Linked Insurance Plan

ULIPs can be beneficial for those seeking insurance coverage and market-linked returns. Assess charges and fund performance to align ULIPs with your financial goals.

ULIP is a financial product combining life insurance coverage with investment. Your premium is divided between insurance and investment in chosen funds.

ULIPs offer life insurance coverage plus the potential for higher investment returns, making them more versatile than Fixed Deposits (FDs), which provide safety and fixed returns.

The main advantage of a ULIP is the dual benefit of life insurance protection and the opportunity for investment appreciation.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.