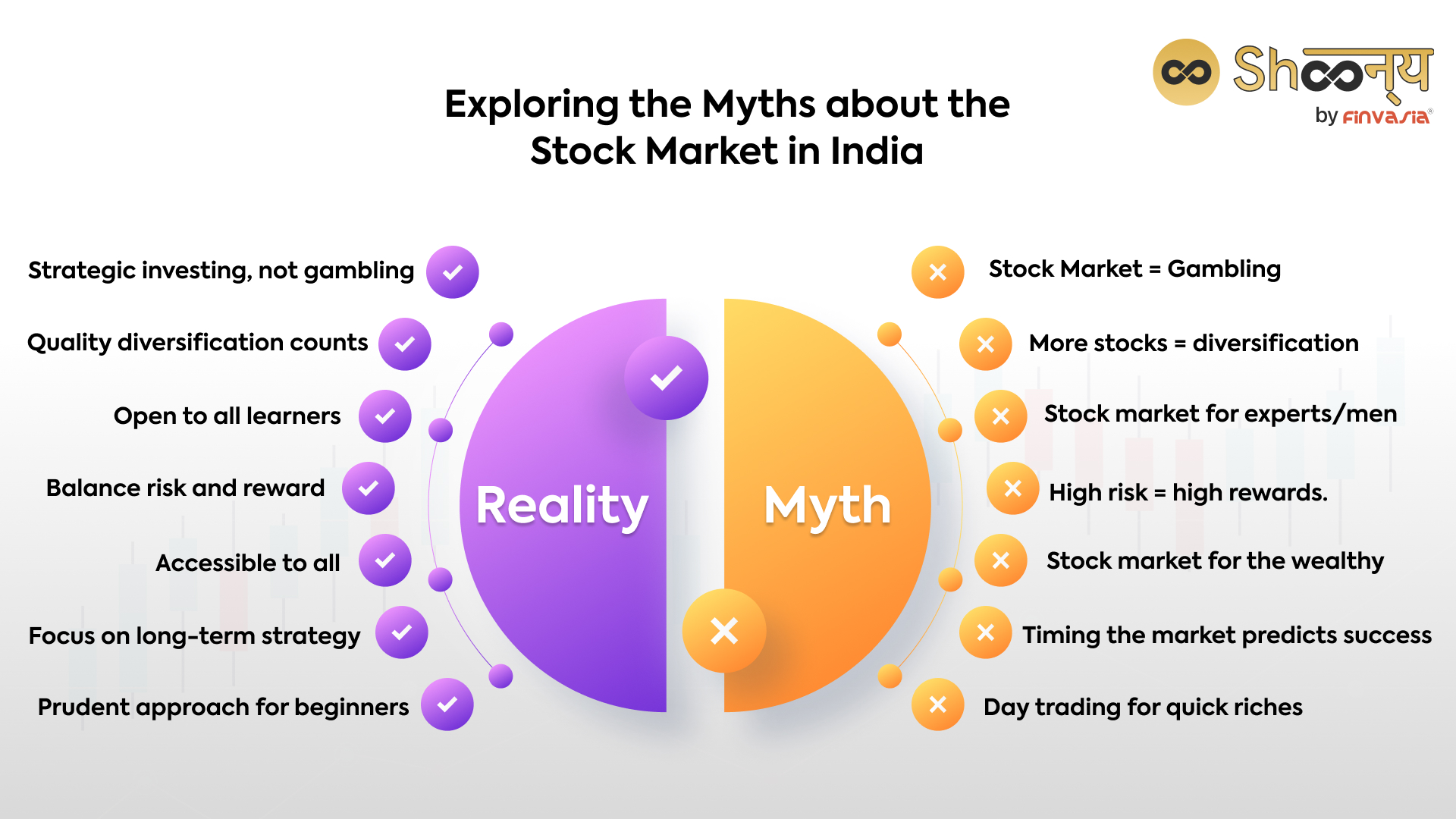

When it comes to the stock market, myths and misconceptions abound, creating barriers that deter beginners from exploring this wealth-building avenue. Today, we’re here to dismantle these myths and shed light on the realities of the stock market in India. So, fasten your seatbelts as we embark on a journey to debunk some prevalent stock market myths and misconceptions.

Stock Market Myth No. 1: Investing in Stocks is Just Like Gambling

One of the most common myths of the stock market is the misconception that investing in stocks is akin to gambling. While both involve risk, they are fundamentally different activities. Investing in stocks is a strategic game that requires knowledge, research, and analysis, while gambling relies solely on chance. To illustrate this, let’s consider two scenarios: randomly picking stocks without any research versus thoroughly evaluating the company’s financials, industry trends, and management competence. It’s evident that informed decisions based on research have a higher chance of success.

Stock Market Myth No. 2: More Stocks, More Diversification

There is a prevalent myth about share market diversification that suggests owning more stocks automatically leads to diversification. However, the reality is that true diversification is not about the quantity but the quality of stocks in your portfolio. For instance, imagine an investor who owns ten stocks in the same industry. If the industry experiences a downturn, the entire portfolio will be negatively impacted. True portfolio diversification involves spreading investments across different sectors and asset classes, such as stocks, bonds, mutual funds, and commodities.

Stock Market Myth No. 3: Stock Market is Exclusively for Experts

There are many myths about the stock market in India, and one common misconception is that it is exclusively for experts. This couldn’t be further from the truth. The stock market investment is open to anyone willing to learn and seize opportunities. Take the example of Neha, a young college graduate who was initially hesitant about entering the stock market. Through dedication and continuous learning, she familiarised herself with stock market basics and gradually gained confidence. Today, Neha successfully manages her own investment portfolio, debunking the myths about stock market expertise.

Stock Market Myth No. 4: High Risk, High Rewards in the Stock Market

A prevalent myth about the stock market is that high risk automatically leads to high rewards. While it’s true that some high-risk investments can bring substantial rewards, it’s not a guaranteed equation.

To demonstrate this, let’s consider Ravi, who invested a significant portion of his savings in a volatile small-cap stock based on a hot tip. Unfortunately, the stock crashed, resulting in substantial losses. On the other hand, Rahul diligently researched and invested in fundamentally strong companies with good track records, enjoying consistent returns over time. Balancing risk and reward is key to successful investing.

Stock Market Myth No. 5: Making Money in the Stock Market is Just for the Wealthy

One of the prevailing myths about the stock market in India is that making money is exclusively reserved for the wealthy. This myth creates a misconception that substantial wealth is a prerequisite for stock market participation. However, today’s stock market caters to investors with different risk appetites and capital. For instance, Priya, a young professional with limited savings, started investing in the stock market with a small amount through a systematic investment plan (SIP). Over time, her investments grew steadily, disproving the myths about stock market accessibility.

Forget the old barriers. Now, with zero-commission online brokers, you can start investing small amounts of money without worrying about hefty fees eating into your returns.

Additionally, AI-based stock market predictions provide valuable insights and analysis, giving beginners the tools to make swift yet smart investment decisions. The stock market is no longer out of reach.

Stock Market Myth No. 6: Timing the Market is the Secret to Success

Another myth about the stock market is the belief that timing the market is the secret to success. Many investors mistakenly believe that predicting short-term market movements consistently is possible. However, even experienced investors find this challenging. Instead of trying to time the market, focus on a disciplined investment strategy. Consider Suresh, who regularly invests a fixed amount in a diversified portfolio of blue-chip stocks. By adopting a long-term approach and staying invested, Suresh has been able to navigate market volatility and benefit from compounding.

Stock Market Myth No. 7: Day Trading is a Shortcut to Quick Riches

Day trading has gained a reputation as a shortcut to quick riches, but it’s a myth that has led many astray. The reality is that day trading is a high-risk activity that requires expertise, constant monitoring, and split-second decision-making. Let’s take the example of Karthik, who, driven by the desire for fast profits, dabbled in day trading without proper knowledge. He soon realised that the volatility and pressure were overwhelming, resulting in significant losses. For beginners, a prudent approach is to focus on long-term investing, which provides a broader range of investment options and the potential for steady growth over time.

In conclusion, debunking these myths about the stock market in India is crucial for aspiring investors. The stock market is not a gamble, and it rewards informed decisions based on research and analysis. Diversification is about the quality, not the quantity, of stocks in your portfolio. The stock market is open to all, regardless of expertise or wealth. Balancing risk and reward is key, and timing the market is an elusive pursuit. Lastly, day trading is a high-risk endeavour best suited for experienced traders. Armed with accurate information and a disciplined approach, you can confidently explore the stock market and unlock its true potential for wealth creation.

Key Takeaways

- Investing in stocks requires knowledge, research, and analysis, unlike gambling.

- True diversification is about the quality, not the quantity, of stocks in your portfolio.

- The stock market is open to anyone willing to learn and seize opportunities, not exclusively for experts.

- High risk does not guarantee high rewards; balancing risk and reward is crucial.

- Making money in the stock market is not reserved for the wealthy; it caters to investors with different risk appetites and capital.

- Timing the market is challenging, and a disciplined investment strategy is more important.

- Day trading is a high-risk activity that requires expertise and constant monitoring; long-term investing is a more prudent approach.

FAQs Related To Stock Market Myths

No, the stock market is not only for rich people and brokers. Anyone can invest in stocks, regardless of their wealth or occupation.

No, investing in stocks is not the same as gambling. While there are risks involved, investing in stocks is based on research, analysis, and long-term growth potential, unlike the speculative nature of gambling.

No, you should not follow experts’ advice blindly. It’s important to do your own research, understand your investment goals, and then make stock market investments based on your own financial situation.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing