Are you someone who has always used “trading” and “investing” interchangeably? Today, you’ll likely have an “aha” moment when we will tell you the huge difference between trading and investing. These two terms often confuse most of us. But they cannot be used interchangeably as they hold different meanings!

Let’s walk you through trading vs investing!

What is Investing?

Investing is a strategy wherein you put money into assets with the expectation of generating a profit over time.

The primary purpose of investing is to grow wealth gradually. This depends upon the assets that you hold that have the potential to increase in value or provide income.

Example of Investing

Suppose you buy shares of a reputable Indian company with strong fundamentals. Now, your goal is to hold onto them for several years, expecting the stock price to increase over time.

What are the important elements here?

Long term focus and the aim to earn profit.

This is a form of investing.

What is Trading?

On the flip side, trading includes buying and selling financial instruments. These could be stocks, bonds, mutual funds, or commodities. Now, in the case of trading, what is the goal?

Making short-term profits from price movements.

Example of Trading

A trader might buy shares of a company and sell them a few days later at a higher price to make a quick profit.

What is the main element here?

Short-term holding for quick profits.

Trading often involves analysing market trends to make the right buying and selling decisions.

Trading vs Investing| Path to Financial Growth

Understanding the difference between trading and investing is crucial:

- Investing is like planting a seed and patiently watching it grow into a tree over time.

It requires a long-term view and is less focused on short-term fluctuations.

- Trading is more like buying fruits at one market and selling them at another market for a higher price on the same day.

It involves quicker decision-making and can be more speculative.

Let us look at the detailed differences between trading and investing.

Trading vs Investing| How Do They Differ?

| Basis | Investing | Trading |

| Time Horizon | Long-term (years to decades) | Short-term (minutes to weeks) |

| Objective | Growth over time | Capitalising on short-term price fluctuations |

| Focus | Fundamental analysis | Technical analysis |

| Frequency of Activity | Low (buy and hold strategy) | High (frequent buying and selling) |

| Holding Period | Holds assets for extended periods | Buys and sells assets quickly |

| Profit Goals | Long-term growth and dividends | Short-term gains and quick profits |

| Risk Tolerance | Generally lower risk | Higher risk due to market volatility |

Trading and investing are both ways to engage in the stock market, but they differ in their approach and objectives.

Time Horizon

- Investing: Involves a long-term perspective, typically holding investments for years or even decades.

- Trading: Focuses on short-term gains, with transactions occurring within seconds to weeks.

Objective

- Investing: Aims for wealth accumulation and growth over time through asset appreciation and dividends.

- Trading: Aims to profit from short-term price movements, often focusing on quick gains.

Focus

- Investing: Relies on fundamental analysis of company performance, market trends, and economic factors.

- Trading: Relies on technical analysis of price charts, patterns, and market indicators.

Frequency of Activity

- Investing: Involves less frequent buying and selling, typically employing a buy-and-hold strategy.

- Trading: Involves frequent buying and selling, sometimes executing multiple trades in a single day.

Holding Period

- Investing: Involves holding assets for extended periods to benefit from long-term growth.

- Trading: Involves buying and selling assets quickly, often within minutes or days.

Risk Tolerance

- Investing: Generally associated with lower risk due to the long-term perspective and diversified portfolios.

- Trading: Involves higher risk due to the potential for market volatility and rapid price changes.

Trading vs Investing|Example

Investing: Buying shares of well-established companies with growth potential and holding them for several years.

Trading: Day trading stocks based on technical indicators and short-term price movements.

Trading vs Investing| Types

Trading and investing have subcategories:

Different Types of Investing

There are various types of investing strategies:

- Value Investing: It involves buying stocks that are undervalued based on fundamental analysis.

- Growth Investing: Investing in companies that exhibit high growth potential in terms of revenue and earnings.

- Income Investing: Focusing on investments that generate regular income through dividends or interest payments.

- Index Investing: Investing in index funds or exchange-traded funds (ETFs). These replicate the performance of a specific market index.

Investors usually adopt one of two investment styles:

- Active Investing

Active investors regularly monitor the markets. They make adjustments to their portfolios based on market conditions.

- Passive Investing

Passive investors use a buy-and-hold strategy. It’s a low-cost, hands-off approach. They match the performance of a market index rather than actively picking individual investments.

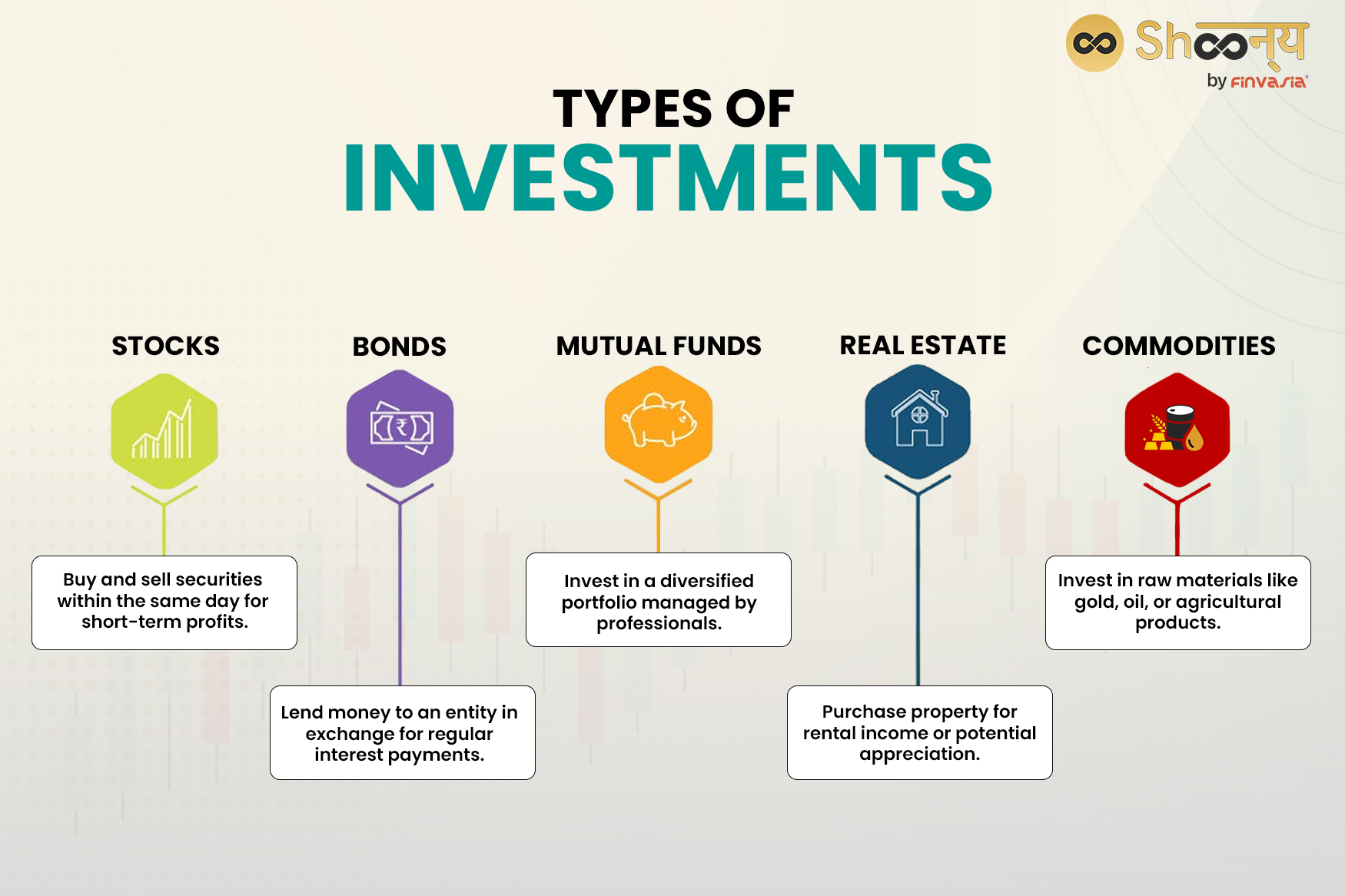

What are the most common investments in the market?

Types of Investments

Stocks

Stocks are shares of ownership in a company listed on the Indian stock market. When you buy stocks, you become a part-owner of that company.

For instance, purchasing shares of a popular Indian company like Tata Motors means owning a small piece of Tata Motors.

Bonds

Bonds are like loans issued by the Indian government or companies. When you buy a bond, you lend money to the issuer in exchange for regular interest payments.

For example, buying government bonds means lending money to the Indian government and receiving interest payments in return.

Mutual Funds

Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other assets. Investing in an Indian equity mutual fund means your money is spread across various Indian companies’ stocks.

Invest in stocks, mutual funds and more; all at zero brokerage!

Real Estate

Real estate involves buying property like apartments, houses, or land in India. Investors in real estate aim to earn rental income from tenants or benefit from property appreciation.

For instance, purchasing a residential apartment in a growing city like Bangalore for rental purposes.

If you don’t want to directly invest in real estate, try REITs- real estate investment trust.

Commodities

Commodities are raw materials or agricultural products like gold, crude oil, rice, or cotton. Investing in commodities means buying these physical goods.

For example, buying gold biscuits or futures contracts of crude oil as part of your investment strategy.

Now comes the next question. What about the types of trading in the Indian Market?

Let’s take a look!

What are the Different Types of Trading

Traders employ different methods and time horizons for trading:

- Day Trading: Buying and selling securities within the same trading day to capitalise on intraday price movements.

- Swing Trading: Holding positions for a few days to several weeks, aiming to profit from short- to medium-term price swings.

- Position Trading: Taking a longer-term approach by holding positions for weeks to months based on fundamental analysis.

- Scalp Trading: Traders aim to make small profits from rapid price movements in the financial markets. Scalp traders execute numerous quick trades throughout the day.

They may often hold positions for only seconds to minutes to a few hours to capture small price fluctuations.

Similarity Between Trading and Investing

The similarity between trading and investing is that both involve participating in financial markets.

- Trading and investing both aim to generate profits or wealth in financial markets.

- Both involve analysing markets and checking economic factors, market conditions, and asset performance.

- Risk management and consideration of financial goals are essential aspects.

Trading vs Investing: Which Should I Choose?

Choosing between trading and investing depends on your financial goals.

Consider and answer a few questions:

- How long can you keep your money invested?

- Do you want to earn quick profits in the short term?

- If yes, what is your risk tolerance?

If you want to build wealth over a longer period and are comfortable waiting years for returns, investing might be the right choice for you.

Investing typically involves less risk and allows you to benefit from compounding returns.

On the other hand, if you prefer quicker profits by taking advantage of market fluctuations, then trading could be suitable.

However, this is not as easy as it sounds and involves a risk element!

Trading requires more time, attention, and a higher tolerance for risk, as it involves frequent buying and selling of assets.

Ultimately, it’s about aligning your financial strategy with your personal objectives.

FAQs|Trading vs Investing

Investing is the process of buying assets with the potential to increase in value over time, aiming for long-term financial growth.

Trading involves actively buying and selling financial instruments like stocks or currencies to profit from short-term price fluctuations.

Whether investment or trading is better depends on individual goals and risk tolerance; investing is typically for long-term growth, while trading aims for quicker, short-term gains.

This depends on several factors like your risk tolerance, your financial goals and your income. Trading is generally considered riskier due to the potential for rapid and significant losses from short-term market volatility, whereas investing tends to be less risky over the long term.

Success can vary widely; investors may benefit from long-term growth and compounding returns, while traders can make quick profits but also face higher short-term risks.

The stock market is the overall platform where securities are issued, bought, and sold, while trading refers to the act of buying and selling those securities within the stock market.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.