Futures: Everything To Know About Them

Futures are derivatives that have no real value but derive their worth from the underlying assets. Check what else you must know.

Futures Market Overview and Analysis

The Indian futures market dates back to 1875, with cotton as the underlying asset. As time passed, new commodities such as oil seeds, jute, wheat, and other agricultural commodities were introduced. Futures trading in precious metals such as silver and gold began in 1920. However, the Securities Exchange Board of India (SEBI) did not introduce futures derivatives in individual securities until 2001.

Futures are available on various exchanges like National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and Multi Commodity Exchange (MCX).

What is Futures Trading in India?

Futures are derivatives that have no real value but derive their worth from the underlying assets. As a contract participant, you have the option to buy or sell at the agreed-upon price on the predetermined date. On the expiry, you may opt for a cash settlement or choose a physical delivery (in the case of commodities).

You can trade in futures by paying a small margin that varies with the underlying securities. They are available in a lot size comprising multiple shares. However, before you proceed further, Understanding the Lot in Futures Trading is crucial.

The exchange and its clearing organisation standardise contract terms such as lot size, expiry date, and contract value.

Suppose you expect ACC Ltd. shares to fall to Rs 2,000 from their current price of Rs 2,440. As a result, you intend to open a sell position in them using futures contracts. The trade requires an 18.96% margin, and the lot size for ACC Ltd is 250 shares.

That means by paying Rs 94,800 (2,000 × 18.96% × 250), you can trade in ACC stocks worth Rs 6,10,000. As expected, the ACC stock price fell to 1800. You will profit Rs 50,000 [(2000 – 1800) × 250].

Various Types of Futures

Futures contracts in India are broadly classified into five types.

- Equity futures,

- Commodity futures

- Interest rate futures

- Index futures

- Currency futures

Each type of futures contract differs in terms of lot size, expiration date, and underlying assets. Beyond the ones mentioned above, cash contracts are another type of futures derivative, but before you trade in them, Decoding the Fundamentals of Cash Contracts is vital.

Futures Contracts: Rules and Regulations

- Only an online screen-based platform can facilitate futures trades.

- The futures exchange must have online surveillance that can track real-time data on volumes, positions, and prices to prevent any kind of manipulation.

- Exchange’s futures segment must have an investor protection fund.

- If a member fails to meet its obligations in terms of asset transfer or transaction execution, it is the exchange clearing house’s responsibility to transfer the default position to a solvent member.

- The contract’s initial margin depends on the risk associated with the position. The margin must be sufficient to cover a single-day loss.

How are Futures Priced?

The following three factors influence futures pricing.

- Dividends: Stock futures do not provide dividend benefits. However, when it is declared by the company whose stocks are the underlying securities of your contract, it reduces the spot price to the extent of the dividend. This leads to an adjustment in the contract’s price.

- Time left in expiry: Derivatives pricing, whether futures or options, is proportional to the contract’s expiration date. The price of a future contract will be higher if the expiry date is far. However, the prices fall as it approaches expiration.

- Risk-free return: It represents the interest rate that you could earn in an ideal market. The foundation for calculation is a Treasury bill. Risk-free returns provide information about the opportunity cost of investing in securities today. The returns are then adjusted to account for the contract’s time value.

Futures pricing formula–

Futures Prices = Spot Price × [1 + Risk-Free Returns × ( Time Left to Expiry ÷ 365) – Dividends]

Explore: Span Methodology To Calculate Futures

Different Types of Futures Trading Strategy

1. Pullback strategy

A pullback in trading occurs when the price of the underlying asset rises, then falls for a short period, say a few consecutive trade sessions, before resuming its upward trend.

Suppose the stock price rises following the release of solid earnings. Shareholders sell their holdings to profit from the price increase. The bulk selling transaction causes price drops, creating a buying opportunity. When new investors buy the stock, the price rises once more.

During an uptrend, set a stop loss below the previous resistance level and aim to profit from recent highs. Conversely, during a downtrend, you must set your stop loss above the previous resistance level and try to benefit from the recent lows.

2. Trading the Range

It is one of the best profitable future trading strategies you can implement when the underlying security price fluctuates between the specific high and low for a particular period. The upper range in trading the range strategy provides traders with price resistance, while the bottom provides price support.

Set a stop loss above the resistance level if you have a short position in the underlying asset. If you are long, your stop loss should be set just below the support level.

While setting a stop loss, leave room for unexpected volatility and breakouts.

3. Buyer and Seller Interest

You must examine the total open buy and sell trades for the specific asset’s contract at various price levels. The Depth-of-Market (DoM) window can help you determine this. If the number of open orders at different price levels is higher, it indicates greater liquidity and vice versa.

The buying and selling interest strategy provides insight into the trade signal and helps to determine whether to open a long or short position.

4. Breakout Trading

A breakout occurs when the underlying security’s price moves outside a specific range. The primary objective of this trading strategy is to keep up with the volatility when the price moves out of the resistance, support, and trendline levels.

During breakouts, there is significant volatility in the market. The reason is the execution of pending orders. According to the breakout trading strategy, opening a short position is ideal if the price breaks below the support level. A long is best when the security price trades below the resistance level.

What are Spreads In Futures?

A spread is an arbitrage trading strategy in which the trader holds both a buy and a sell position on the underlying asset. The primary objective of the futures spread strategy is to profit from price differences.

Suppose you are confident in the price volatility of the fictitious ABC Ltd stocks. Given this, you take a buy position on one contract with a strike price of Rs 2000 and a sell position on another.

Regardless of market movement, here is an opportunity to profit from the price discrepancy.

The futures spread can either be vertical or horizontal spread.

Tips to Consider When Trading in Futures

- Trade plan: Understand the market trend and decide your position accordingly.

- Protect your position: Set a stop loss to protect yourself from unfavourable price movement.

- Diversification: Maintain a diverse futures portfolio. Keep in mind that commodities and stocks have an inverse relationship. Exposure to multiple asset classes will help you hedge while increasing your profit potential.

- Consider margin calls: Margin calls in futures are demanded in a losing trade when the underlying asset increases or decreases in value relative to the trend prediction. Before this situation arises, it is always preferable to exit your position rather than pay additional funds into your account to maintain the losing trade.

What are the Benefits of Trading a Futures Contract?

- High Leverage: Futures do not require a total investment and can be traded by paying a margin of 10-20% of the underlying asset’s total value. If the price moves against you, you will be required to pay the deficit, also known as the margin call.

- Liquidity: The futures market has a large number of buyers and sellers. Every day, a large number of futures contracts are bought and sold. This ensures that orders are processed immediately. The likelihood of a wider bid-ask spread as a futures contract approaches maturity is also low. That means even large orders are processed smoothly without causing the underlying security price to fluctuate.

- Diversification: Futures allow you to choose from multiple asset classes. You can speculate on stocks, currencies, interest-bearing instruments, and commodities.

- Two-way trade: The cash market will only help you profit when the market is rising. Whereas; the F&O market allows for two-way trading. You can make money by opening a short position even in a down market.

What are the Disadvantages of Futures Trading?

- Uncontrollable events: Natural disasters, government policies, and warlike situations are beyond the traders’ control. When such a scenario occurs, however, it has a significant impact on security prices and can turn your profitable trade into a loss.

- Leverage risk: Future traders’ access to leverage benefits can sometimes work against them. Usually, such trades necessitate a 10-20% margin payment. If you open the wrong position and prices move against you, you will lose your entire deposit. If you do not square off your position at the right time, you will be required to pay the deficit amount to remain in the trade.

- Complexity: Future trades are difficult to understand. The exchange standardises lot sizes and margin requirements for different securities. Furthermore, futures trading strategies differ from cash market equity trading strategies. All this makes trading difficult for beginners and increases the risk of loss.

How are Futures Contracts Settled?

Futures contracts are settled either on the contract’s expiration date, which is the last Thursday of the expiry month or daily. The latter occurs when a trader discovers a profitable opportunity or wishes to square off due to consistent price movement in the opposite direction of their position.

The concept of mark-to-market (MTM) applies to daily settlement. Here, regardless of whether you close your position, it is assumed that you have marked your position at the underlying security’s prevailing market price to eliminate price risk. After calculating the settlement price for the day, the value of all open contracts is reset to the arrived price. On the following trading day, all carry forwards trades will now use this price as the foundation for the next day’s MTM calculation.

Contracts subject to final settlement consider the underlying asset’s spot price on the expiry date.

How to Trade in Futures?

- Understand the various risks associated with futures contracts.

- Assess your risk-taking abilities.

- Choose your trading strategy.

- Set up a simulated F&O trading account to practise futures trading.

- Create a DEMAT account

- Make arrangements for margin money.

- Choose from a variety of available futures.

- Select the F&O stocks lot size

- Place your order

- Settle/square off your position

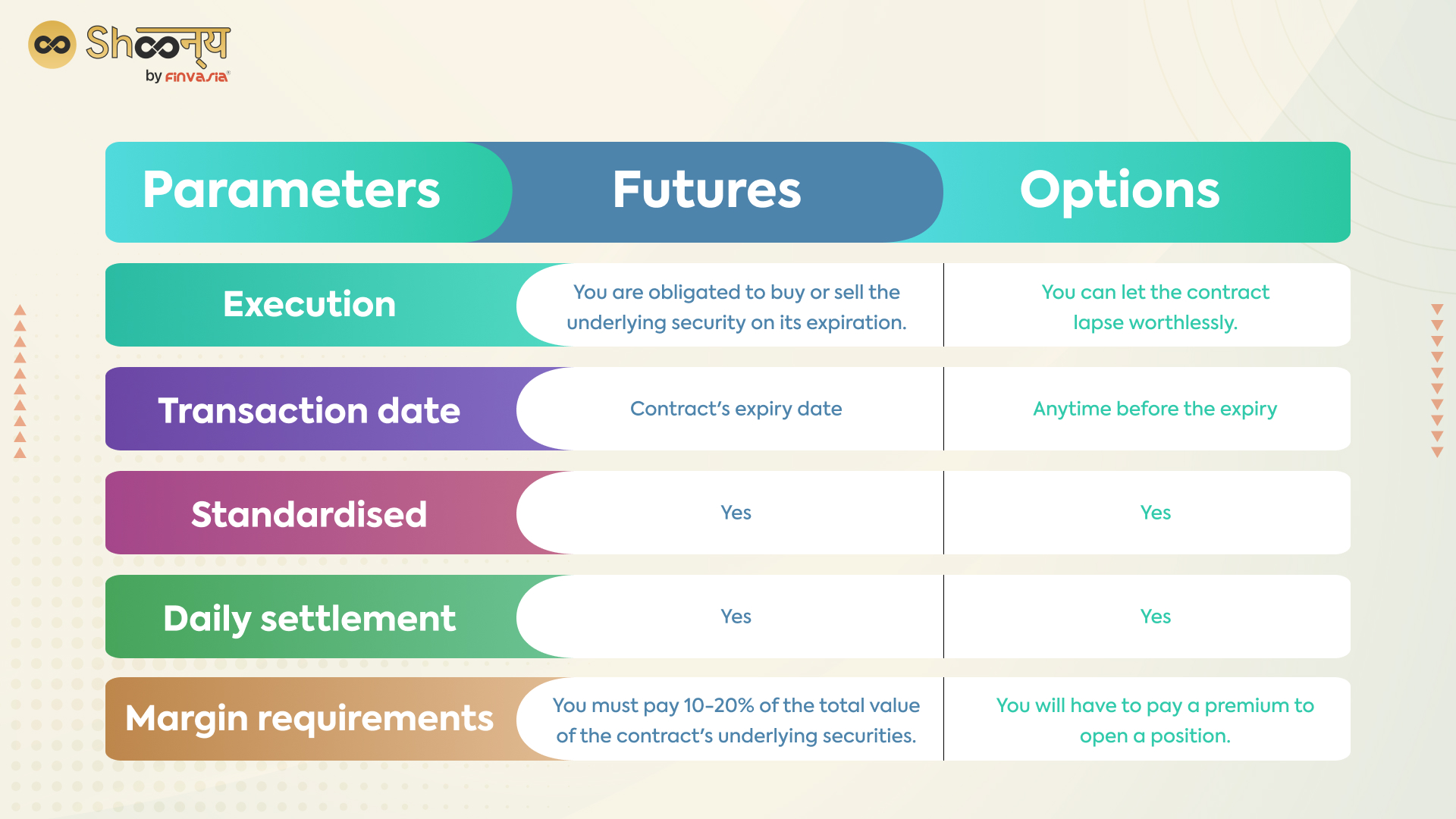

Futures and Options Market Differences

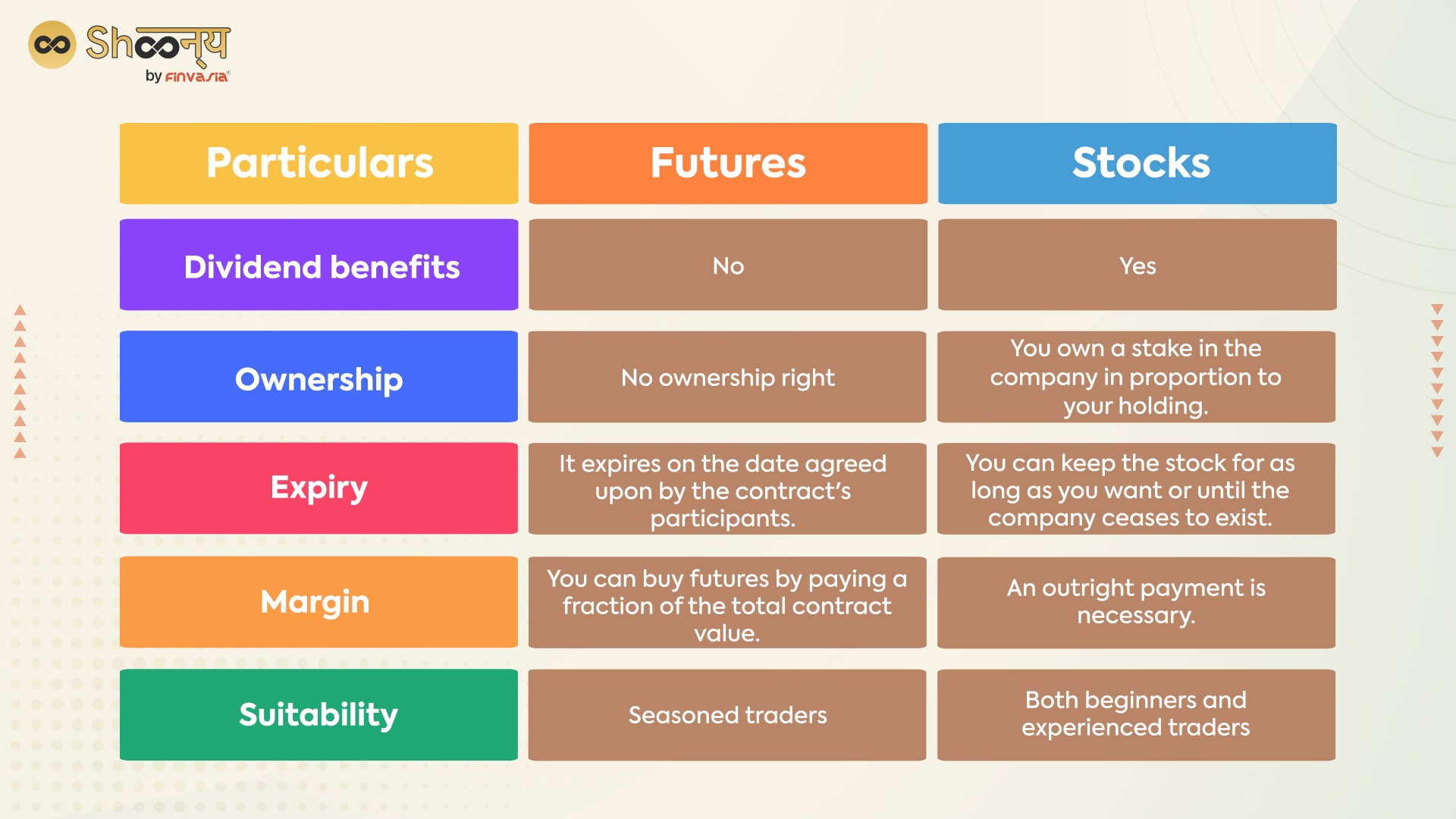

Comparison between Futures and Stocks

Comparison between Futures and Margin Trading

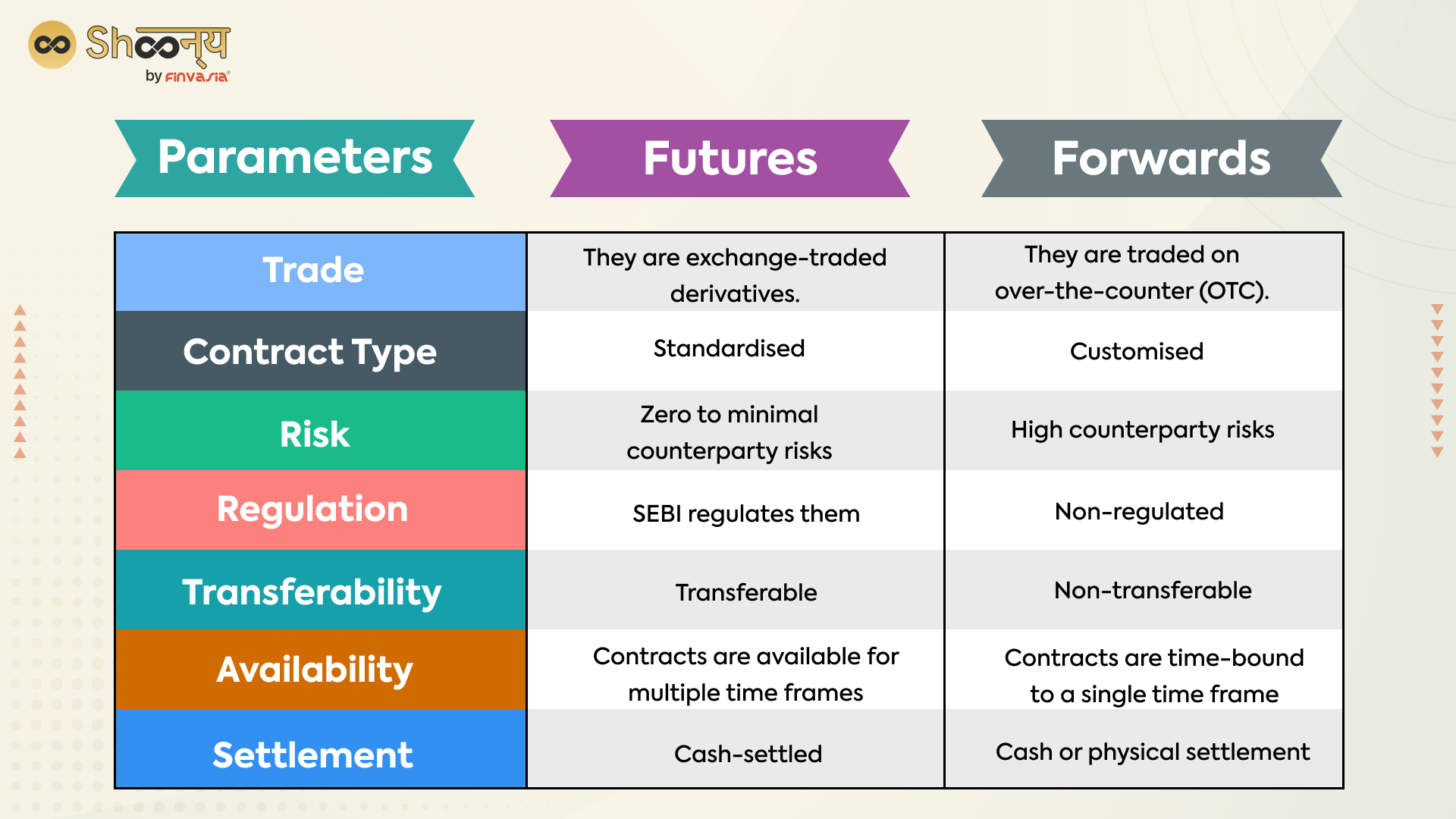

Comparison between Futures and Forwards

What is the Loan Program in Future derivatives?

A loan programme in futures derivatives refers to a government scheme in which funds are made available to farmers at predetermined rates. The money is then used by the farmer to crop the plant in the coming days, which also serves as collateral in the loan scheme. If the farmer fails to make his payments, the government takes possession of the agricultural commodities that he has produced.

What is After Hours Trading in Future derivatives?

After-hours futures and options trading timing refers to placing orders outside of usual market hours. It enables traders abroad to access the Indian market when it is convenient for them. The NSE has scheduled after-hours trading for F&O derivatives from 3:45 pm to 9:10 am.

After-hours trading allows you to take advantage of market news and financial releases to determine your position.

FAQs

Futures are contracts where buyers and sellers agree on a future date and price to trade assets, like stocks or commodities, used for hedging or speculation.

Examples include a gold futures contract for 1 kg of gold, a crude oil futures contract for 100 barrels, and a Nifty 50 index futures contract for 75 units.

Futures trading involves buyers and sellers entering contracts to trade assets at agreed prices and dates. These contracts are standardised, traded on exchanges, and offer various trading strategies.

A futures market in the stock market allows traders to buy or sell futures contracts for stocks or indices, providing tools for hedging, speculation, and price discovery.