How to Create a Retirement Portfolio in 2023

A blissful retirement is every individual’s dream, but fulfilling this dream isn’t far from your reach if you are focused. It requires careful planning and strategic decision-making to ensure a retirement portfolio aligns well with your current income stream, risk-taking ability, and long-term financial goals.

If you are still wondering which route to choose or finding the best way to manage your retirement portfolio’s, you are at the right place. We have designed this blog strategically to help you plan your retirement income in advance.

It’s time to seize control of your financial future and embark on a journey toward a retirement that’s not just comfortable but extraordinary.

What is a Retirement Portfolio?

A retirement portfolio’s serves as a strategic investment plan tailored to meet your post-retirement financial needs. It provides a diversified approach to help you manage and grow your wealth while ensuring a comfortable retirement.

Imagine you’re having a casual conversation with one of your party friends. As retirement comes up in the discussion, he enthusiastically shares his retirement investment plans. He mentions how he has carefully diversified his investments, including options like PPF and mutual funds, to ensure a secure financial future. While listening to him, you feel curious and, at the same time, worried about how these investment strategies work together in a retirement portfolio. How you still haven’t made a single long-term investment for yourself.

Have you also experienced such things but still need to learn how to take the first step towards it? This comprehensive guide shall answer all your queries related to an effective and well-diversified retirement portfolio.

Building Blocks of a Retirement Portfolio

Identifying Your Financial Goals and Risk Tolerance

Before embarking on your retirement portfolio journey, take the time to identify your financial goals. For example, do you envision a modest or more luxurious retirement? You can establish a clear roadmap for your investment strategy by defining your goals. Additionally, assessing your risk tolerance will help you determine how much volatility and risk you are willing to accept in pursuit of higher returns.

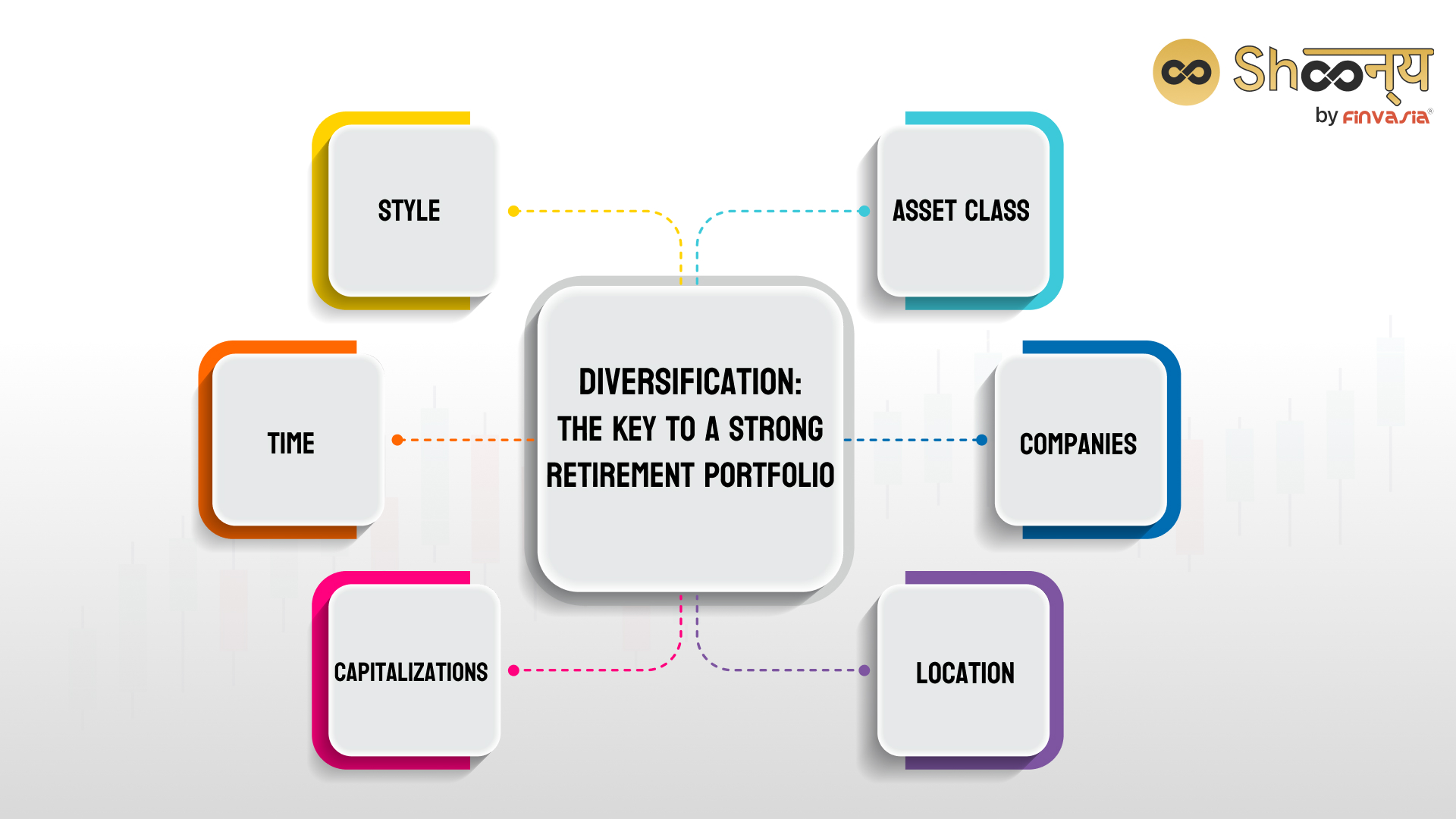

Diversification: The Key to a Strong Retirement Portfolio

A well-diversified retirement portfolio is the foundation for long-term success. Diversification involves spreading your investments across various asset classes such as stocks, bonds, mutual funds, and commodities. By allocating your assets across various investment types, you reduce the risk associated with any single investment. This is considered to be the best retirement portfolio approach that ensures that the performance of your portfolio is not solely reliant on a single investment or sector, providing a cushion against market volatility.

Constructing Your Retirement Portfolio

Determining the Ideal Asset Allocation

The first step is to make the right retirement investment strategy. Asset allocation plays a pivotal role in creating a balanced retirement portfolio. It involves deciding how much of your portfolio should be allocated to different asset classes based on your financial goals and risk tolerance.

Check how you could use bonds as an effective investment for your retirement.

For example, a conservative approach may include a higher allocation to fixed-income assets like bonds, while a more aggressive strategy may emphasise equity investments for potentially higher returns. Striking the right balance is crucial in aligning your portfolio with your unique circumstances.

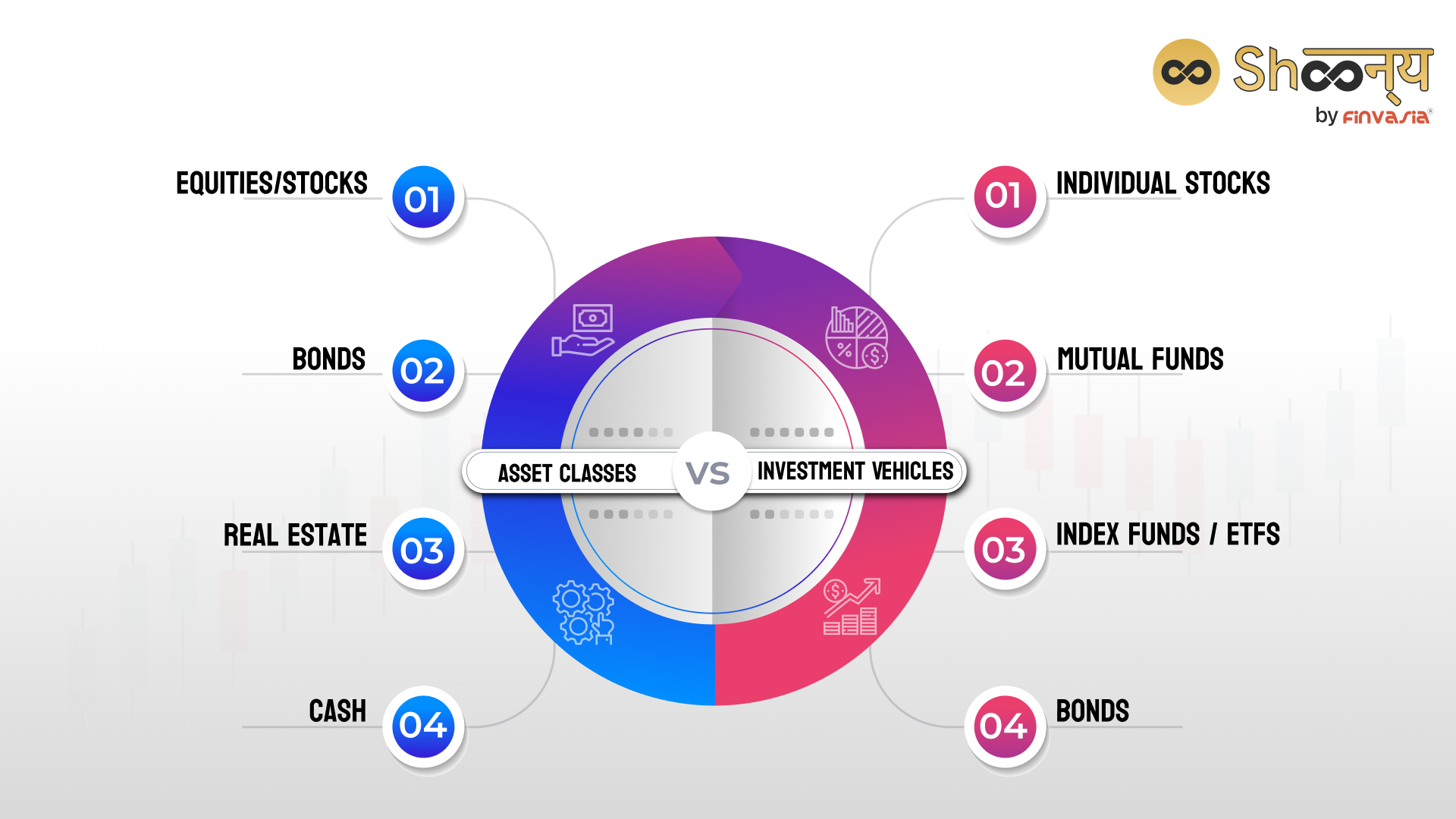

Choosing the Right Investment Vehicles

Managing Your Retirement Portfolio

Regular Portfolio Review and Rebalancing

Maintaining a successful retirement portfolio requires periodic review and rebalancing. Market fluctuations may cause your portfolio’s asset allocation to drift from your intended targets over time. Regularly assess your portfolio’s performance, compare it against your goals, and rebalance if necessary. Portfolio Rebalancing is a must-step to align your asset allocation with your target percentages. This disciplined approach ensures that your portfolio remains aligned with your long-term objectives.

How to Plan Retirement Income In India?

Planning retirement income in India involves considering various factors. Start by estimating your desired post-retirement expenses and evaluating your current savings. Then, explore retirement-specific long-term investment options like National Pension Scheme (NPS), Public Provident Fund (PPF), and Employee Provident Fund (EPF). Consider diversifying investments in mutual funds, fixed deposits, and even real estate. Avail tax benefits and consider health insurance to mitigate potential medical expenses. Finally, regularly review and adjust your retirement plan as to changing needs and market conditions.

Retirement Portfolio Examples: Few Hypothetical Situations.

- Conservative Approach: A retiree seeking capital preservation might allocate 40% to stocks, 50% to bonds, and 10% to cash equivalents.

- Balanced Approach: An individual with a moderate risk tolerance may allocate 60% to stocks, 30% to bonds, and 10% to real estate investment trusts (REITs).

- Growth-Oriented Approach: A younger investor with a long time horizon may allocate 80% to stocks, 15% to equities, and 5% to alternative investments like commodities.

Note- Planning retirement income in India requires careful research and consideration of individual circumstances. The following example is hypothetical, and it is important to conduct thorough research and seek professional advice before making financial decisions.

Best Practices for an Effective Retirement Portfolio

To optimise the effectiveness of your portfolio, you could try implementing these common activities to manage your retirement portfolio:

- Regularly review and adjust your portfolio based on changing circumstances and market conditions.

- Stay up to date about market trends and seek professional portfolio management services and advice if needed.

- Periodically revisit and update your financial goals to ensure your portfolio aligns with your evolving needs.

- Practice discipline and avoid emotional investment decisions during market fluctuations.

- Research well to ensure that you don’t commit bad investment mistakes that may cause additional burdens to your budget and financial planning.

Securing Your Future with a Thoughtfully Designed Retirement Portfolio

Creating a retirement portfolio is a journey that requires careful planning, continuous monitoring, and periodic adjustments. By understanding the importance of diversification, identifying your financial goals, and implementing a disciplined investment strategy, you can build a robust retirement portfolio that provides financial security and peace of mind.

- Start Early, Stay Focused– adapt to changing market conditions to secure a comfortable retirement for yourself and your loved ones.

- Initial Investments- When you are in the early stages of your career, adopting an aggressive investment stance is the most common retirement investing strategy. With time on your side, you have the resilience to withstand market fluctuations and the ability to recover from any temporary setbacks. By prioritising equities, you position yourself to benefit from long-term growth opportunities.

- Later Stage of Life- However, a more conservative investment approach may be appropriate for retirement. Your risk tolerance tends to shift, and the focus shifts towards preserving your accumulated wealth. Balancing your portfolio with a mix of fixed-income investments, such as bonds or real estate, can provide stability and reduce volatility. These investments offer a reliable income stream and cushion against market downturns, protecting your savings as you transition into retirement.

- Growth Element- Recognising the significance of including a growth component in your portfolio throughout your retirement years is essential. Inflation erodes the purchasing power of your savings over time. By allocating some of your investments to growth-oriented assets, such as stocks or real estate investment trusts (REITs), you safeguard against inflation and ensure that your wealth continues growing.

In Conclusion,

Remember the best retirement portfolio is not a one-size-fits-all solution. It must be tailored to your specific circumstances, goals, and risk appetite. Regularly reassess your portfolio and make adjustments as needed to align with your evolving needs. Seek guidance from financial professionals who can provide personalised advice based on your unique situation.

Key Takeaways

- Understand the importance of a retirement portfolio for a comfortable and extraordinary retirement.

- Diversify your investments across asset classes to reduce risk and manage market volatility.

- Determine your financial goals and risk-taking ability before building your retirement portfolio.

- Choose the right investment vehicles, such as mutual funds, index funds, and bonds.

- Regularly review and rebalance your portfolio to stay aligned with your long-term objectives.

- Plan retirement income in India by considering factors like post-retirement expenses, savings, and investment options.

- Examples of retirement portfolio approaches: conservative, balanced, and growth-oriented.

- Follow best practices like staying informed, adapting to market conditions, and avoiding emotional investment decisions.

- Start early with an aggressive investment stance and transition to a more conservative approach as you near retirement.

- Include a growth element in your portfolio to protect against inflation and ensure long-term wealth growth.

FAQ

Maintaining a retirement portfolio involves periodic reviews, adjustments, and diversification of investments to align with your goals and changing market conditions.

A big retirement portfolio mistake is being too conservative, limiting growth potential. Balancing risk and reward is crucial to effectively manage your retirement portfolio.

The ideal asset allocation for a retirement portfolio depends on age, risk tolerance, and financial goals. A balanced approach should be adopted with a mix of stocks, bonds, and market investments

Inflation erodes the purchasing power of your retirement portfolio. To counteract it, include investments that can outpace inflation and consider inflation-protected securities like bonds.

Choose a consistent review frequency, such as monthly, quarterly, semi-annually, or annually, and stick to it to maintain disciplined portfolio management. Setting a consistent schedule helps avoid impulsive decision-making and allows for a disciplined approach to portfolio management.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.